Buscar

-

The Unmatched Health Benefits of Snowshoeing

Snowshoeing is an excellent winter workout that can help burn calories, strengthen muscles and boost cardiovascular health. Explore the top 8 snowshoeing spots and experience this ultimate workout adventure! Significant Health Benefits: Exceptional cardiovascular workout – burn up to 1,000 calories per hour! Low-impact muscle building Endurance building Balance strengthening and agility Improves your sense of well-being by connecting to nature Prepping for Your Adventure There are some crucial details to think about when it comes to snowshoeing, especially if you are a beginner. Make sure to pick the right kind of footwear to go on top of your snowshoes; a pair of comfortable waterproof boots are a great choice and remember to wear lots of layers. Several local places rent snowshoes if you aren’t sure about spending money on a pair. Check out Bobos Ski and Board Patio or our local REI Co-Op. Check out REI’s Beginner’s Guide to Snowshoeing for reference. 8 Cool Snowshoeing Spots 1. Galena Creek Park Close to Reno, this beautiful, low-altitude park offers several trails. You’ll find various creeks and streams under cover of pristine ponderosa pines. From beginner to advanced, the differing trail systems provide a challenge for everyone! Head west on State Route 431 (Mt. Rose Highway) for about seven miles until you see the park sign on the right side of the highway. 2. Tahoe Meadows – Chickadee Ridge This local favorite not only gives fantastic views of Lake Tahoe but the best part? – friendly little chickadees will eat seeds right out of your hand! Be sure to pack plenty of sunflower birdseed, as that seems to be their favorite. From the trailhead parking lot, head southeast into the open meadow. Then follow the ridgeline to your right (southwest). Continue southwest up toward the top of the ridgeline to the west, and you’ll get to Chickadee Ridge in just under two miles. 3. Spooner Lake Trail The easy 2.5-mile loop around Spooner Lake is excellent for all skill levels. This alpine lake is surrounded by aspen trees which house varied bird species, so bring your binoculars! Dogs are allowed on a leash, and all-day parking is $10. 4. Kirkwood Ski Resort You’ll need a trail pass, but this South Lake Tahoe resort has various routes from beginner to advanced, with roughly 50 miles of terrain. Nighttime snowshoe treks during the full moon are also available throughout the winter. Kirkwood is located on Highway 88, close to Carson Pass. 5. Camp Richardson Heading north, you can find this well-established and favorite local snowshoeing spot. If you’re up for an adventure, you can trek up to Fallen Leaf Lake. It’s located off Highway 89 and near Fallen Leaf Road. 6. Dry Pond Loop This moderate, 6.5-mile loop near Washoe Valley has impressive views of Carson Valley, Washoe Lake, and the Mt. Rose Wilderness. If you like the sound of rushing water, most of the trail meanders along White’s Creek. This area is dog-friendly and kid-friendly, which makes it a family favorite. 7. Royal Gorge Soda Springs is home to this resort, which is well known for its cross-country skiing trails. Enjoy extensive trails leading deep into the trees with spectacular views. Find Royal Gorge from the Soda Springs exit on West Interstate 80. 8. Ash Canyon Creek Tucked away in the Carson Valley, these trails are filled with mountain bikes in the spring and provide excellent snowshoeing trails in the winter. Find it from Interstate 580 by taking the Highway 395 Business exit to Winnie Lane.

Read More About The Unmatched Health Benefits of Snowshoeing

-

The Impactful Role of Renown Health Foundation's Board of Directors

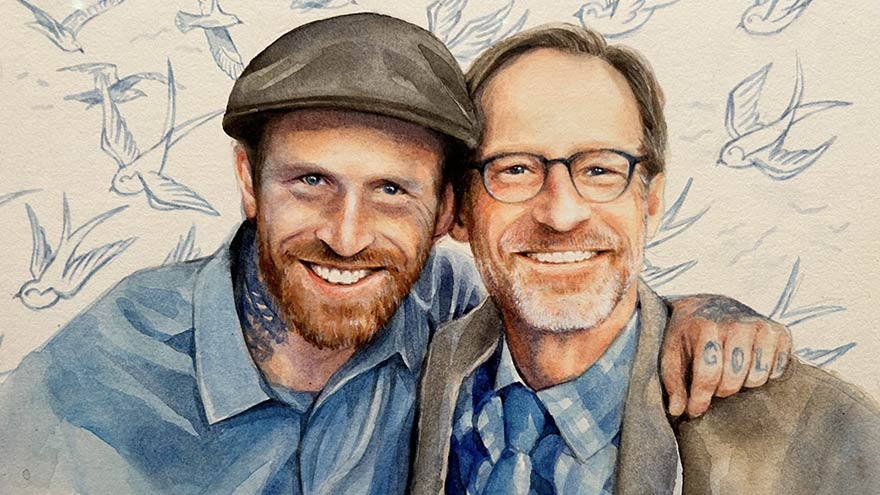

Above: Brian Cushard (left), Renown Health Foundation Board Chair, with his family At Renown Health Foundation, our mission is simple yet powerful – to raise funds that support Renown Health, the largest not-for-profit health system in northern Nevada. We are the driving force behind initiatives that bring state-of-the-art equipment, conduct groundbreaking research, enhance healthcare services, improve patient outcomes and contribute to the overall well-being of our community. Our Dedicated Board of Directors Our impactful work would not be possible without our Board of Directors – a fantastic team of 27 local volunteers. They bring diverse skills to the table, working together to create positive changes in healthcare for northern Nevada. Our board is at the core of our Foundation's success by guiding important decisions, sharing valuable insights and actively engaging in community relationships. Meet Brian Cushard – Renown Health Foundation’s Chair Brian Cushard took on the role of Foundation Board Chair at the beginning of 2024. Brian, who is the President of LP Insurance Services in Reno, will lead us for the next two years, bringing a wealth of experience and a deep commitment to community well-being. Since joining Renown Health Foundation’s Board in 2018, Brian has been instrumental in shaping our strategic direction. Brian’s Vision: Advocating for Renown Health’s Mission and Making a Difference We had the opportunity to sit down with Brian and explore his passion for healthcare philanthropy and the positive changes he envisions. Brian's 'why' is firmly rooted in the belief that a robust health system serves as the backbone of the community. His vision extends beyond fundraising; it's about inspiring the community by sharing remarkable stories of care and championing Renown's impactful contributions. Q: Why does Renown's mission matter to you, and how do you see your role making a difference? A: Renown's mission matters deeply to me because, without a highly functioning healthcare system, the economic structure of the community can be impacted. At LP Insurance, where I work, we see ourselves as guardians of our clients' hopes and dreams. This translates to my role on the Board as stewards for the health of others. Advocating for a highly functioning health system is crucial in supporting community members and clients alike. Surrounding ourselves with a solid network is essential. As advocates, our voices are integral in ensuring that everyone's voices are heard. Q: Can you share a moment that made you want to support healthcare causes? A: There are those stop-in-your-tracks healthcare moments that make you reassess life's priorities. I've had moments where life comes to a standstill, and what you once thought was important takes a backseat to the basics of life—getting better, one step at a time. In those vulnerable moments, you realize the importance of every person at the hospital. In desperate need, we rely on them. It's eye-opening and gives perspective on what's truly valuable in life. Q: Tell us about a time when you saw the positive impact of healthcare or philanthropy. How did that influence your decision to get involved? A: One impactful moment in philanthropy stands out — the Music and Miracles concert featuring the Beach Boys. LP Insurance was a major donor, contributing $100,000 to benefit Sophie’s Place, a music therapy room coming to Renown Children's Hospital. On the day of the event, my wife and I volunteered and saw the remarkable community support for Renown Children’s Hospital. The collective efforts that day raised over $1 million, specifically designated to establish Sophie’s Place. This experience inspired me to want to do more, as I recognized the profound positive impact that philanthropy can have on healthcare and the community. Note: Sophie’s Place, opening later this year, will offer vital care and healing experiences for young patients at Renown Children’s Hospital.

Read More About The Impactful Role of Renown Health Foundation's Board of Directors

-

Departamento destacado: Fundación de Renown Health

Kick off 2024 with us as we celebrate the team behind our very own Renown Health Foundation! When you visit Renown Health, you take a look around and can’t help but notice the robust programs in place. You look left and see our thriving Children’s Miracle Network Hospital at Renown, making a lasting impact on pediatric healthcare in our region. You look right and see the advanced William N. Pennington Cancer Institute, providing leading-edge treatments right here in our community. You look around you and notice an influx of smiling nurses from the Orvis School of Nursing at the University of Nevada, Reno (UNR) who receive tuition assistance, thanks to generous donations to the Gerald “Jerry” Smith Academic Practice Partnership. Then, you think to yourself: “These programs must need a lot of money and support. So, how on earth is this all possible?” What you may not know is that these programs are funded by the generosity of our community, all made possible by the work of Renown Health Foundation. As the largest not-for-profit health system in northern Nevada, our mission to make a genuine difference in the health and well-being of everyone we serve flourishes because of the donations, sponsorships, endowments and more that our Foundation brings in from philanthropists all over the region. Making It Happen The reach of Renown Health Foundation has proven to be virtually limitless, with a clear focus on supporting and raising funds for programs and initiatives that enhance the lives of our patients and their families, all for the betterment of our community for years to come. Under their growing umbrella, the dedicated team at the Foundation makes miracles happen through administering a wide range of philanthropic programs, including: Children’s Miracle Network Hospitals (CMNH), a nonprofit organization that supports the health of 10 million children in the U.S. and Canada every year. Renown Children’s Hospital is proudly recognized as a member of CMNH. Gerald "Jerry" Smith Academic Practice Partnership, a partnership between Renown Health and the UNR Orvis School of Nursing to provide 24 nursing students a year with full-ride tuition assistance and a guaranteed career in nursing at Renown. Fianna’s Healing Garden, a healing garden bringing serenity to all at Renown Regional Medical Center, built from the vision of Fianna Dickson Combs. Miracles at Montreux Golf Tournament, an annual golf tournament that takes place at Montreux Golf & Country Club and consistently raises hundreds of thousands of dollars for Renown Children’s Hospital. A full slate of individual giving programs, including Legacy Giving, Employee Giving and Leadership Giving. But it doesn’t stop there – the Foundation is helping our health system build more ways to care for our community by securing major gifts to fund advanced healthcare facilities and innovative healthcare solutions: William N. Pennington Cancer Institute, the premier oncology institute in the region providing a large array of personalized cancer care services, including Medical Oncology, Infusion Services, Clinical Research and more. Renown Institute for Robotic Surgery, offering the latest advancements in surgical technology with robotic-assisted surgeries, which ensure precision, faster recovery and improved outcomes. Sophie’s Place, a state-of-the-art music therapy room currently in construction at Renown Children’s Hospital. This new space will be specially designed for children and their loved ones to enjoy the healing power of music and engage in the arts. Conrad Breast Center, the latest addition to the planned Specialty Care Center at Renown South Meadows Medical Center which will include breast imaging, infusion and surgery services along with a wellness center. Jeanne and Raymond Conrad donated a $5 million lead gift to support this important project and the Foundation team is currently working to raise an additional $6 million in 2024. It may go without saying that a day-in-the-life of these spirited team members is never a dull one. Every day brings on a new challenge to face and a goal to meet. “A day at the Foundation is a day full of emails, calls and visits with friends of Renown,” said Abbey Stephenson, Planned Giving Officer. “Our main goal is to raise funds to support the mission of Renown, and most of our outreach efforts are to encourage philanthropy and donations. We have a very collaborative team, so we can often be found in each other’s offices strategizing about fundraising initiatives, communications and next steps with specific supporters.” “For me, a typical day involves making sure I have a donor scheduled for coffee or lunch, working on proposals that may need research and preparing presentations,” added Jerry Cail, Major Gifts Officer. “Staying connected, I send thank you notes for any donations-usually once a week and make at least three ‘Grateful Patient’ calls to set appointments. I always make sure I am ready to contribute to any meetings I have for the Foundation." While the scope of the Foundation’s charitable efforts goes beyond hospital walls, they also thrive right here in our own health system. Through our Grants Program, Renown’s departments and programs can leverage the connections and skills Renown Health Foundation has in order to secure funding from a multitude of grant sources. "Grant funds from foundations, and local, state and federal governments benefit the patients and communities we serve to further our mission, vision and values,” said Pam Citrynell, Development Officer. “Past grants have supported the purchase of state-of-the-art equipment, facility development, pandemic recovery, research and clinical trials, physician and researcher recruitment, community health programs and educational training for our healthcare professionals.” Every Foundation team member lives their passion every day while at work, frequently expressing gratitude for the immense impact they have the opportunity to make. “I love coming to work because I get a very real opportunity to make a genuine difference and meet some fantastic people who believe in and support our mission,” said Leah Nelson, Director of Community Giving. “I have had the honor of meeting donors and the families they support. I couldn't be prouder of what our team has accomplished over the years and am excited for what is to come.” The impact of the Foundation team’s tireless efforts extends far into the future, securing Renown’s lasting legacy in contributing to the continued health and well-being of our community. “Philanthropy is not only a financial science but a very specific methodology where connecting resources are paramount; it requires careful intelligent management coupled with lots of hard work, patience, and vision,” said Yvonne Murphy, Development Officer. “The work that the foundation does every day makes resources available to enhance the healthcare experience for all those who seek care at Renown. Our work impacts not only this present moment but in fact is a legacy that will bless this community beyond our lifetime.”

Read More About Department Spotlight: Renown Health Foundation

-

A Token of Appreciation: Renown’s Employee Giving Program

Pictured above from left to right: Jessica Bajwa, Nancy Bell, Laurie Goodman and Troy Fernandez As we approach the holidays and the season of giving, we reflect on the generosity and kindness that our employees here at Renown embody. Since 2007, Renown employees have donated $2,931,018 through Renown’s Employee Giving Program. This program provides our staff with the opportunity to make a difference by funding advanced equipment, research, community health initiatives, professional training and more. Regardless of the dollar amount, every contribution has a meaningful impact and remains entirely within Renown to support our mission. Employees can participate in the program at any time of the year by signing up for recurring payroll deductions or by making a one-time donation of any dollar amount. They can donate to one of Renown’s top priority areas of support or a different fund of their choice. Meet Jessica, Nancy, Laurie and Troy Renown employees Jessica Bajwa, Nancy Bell, Laurie Goodman and Troy Fernandez all have their own reasons for participating in the Employee Giving Program, but they all share the same goal: To give back to their community. Jessica Bajwa has been working at Renown for about seven years. She was at an employee event five years ago and found out about the Employee Giving Program through Renown Health Foundation. They explained the different areas she could donate to and how to get signed up. When Jessica looked back on the comforting care and healing her daughter had received at Renown Children’s Hospital, she felt empowered to give back to other children and families staying at Renown, so she enrolled in recurring payroll deductions to donate to Healing Arts. “It’s so easy and convenient to sign up,” said Jessica. “It means a lot to me to give to this area where they provide a healing environment, especially for patients and families at Renown Children’s Hospital – My daughter still has a blanket they gave her when she was there,” Jessica said she likes that the Employee Giving Program allows employees to choose their area of support to donate to and donation amount. Nancy Bell said she’s proud to give back to Renown after having received a great amount of support from her coworkers during an incredibly difficult time when a family member of hers was being cared for in Renown’s ICU, just three weeks into her employment at Renown. “I had employees from not just my team but also across the organization reaching out to me and checking in to see how I was doing,” said Nancy. Nancy said she was positively impacted by that kind of support through her work family at Renown and decided to start giving back in 2011 by signing up for recurring payroll deductions to donate to the William N. Pennington Cancer Institute – to this day, she is still making donations to this area of support. When Laurie Goodman began working at Renown in 2013, Renown’s Human Resources team offered her different ways to give back as an employee. “At the time, I was often caring for foster children and seniors,” said Laurie. “My family and I have always wanted to help others in need.” Laurie had been taking care of an elderly woman who was a patient at the old Renown Skilled Nursing Facility and decided to enroll in payroll deductions to donate to this facility. When that facility closed, she received a letter asking which area she wanted to transfer her donations to, and she decided to begin donating to Renown Children’s Hospital to give back to kids in the community. “I’m fortunate for not only my employment at Renown, but my husband’s and daughter’s employment as well. As employees of Renown, we have such great jobs, benefits and opportunities, and I think we should all strive to give back to express our gratitude and appreciation.” At his employee orientation in 2012, Troy Fernandez heard about Renown’s Employee Giving Program and learned that funds were needed for individuals who needed financial support to pay for healthcare services at Renown. He knew his donations would go to a good cause and signed up for recurring payroll deductions to donate to the Greatest Need Fund. “It feels good to be able to give back to those who are less fortunate than us,” said Troy. “It was very easy to enroll in this program, and I’ve been donating to the same support area ever since.”

Read More About A Token of Appreciation: Renown’s Employee Giving Program

-

Health Insurance Terms Explained: HMO, EPO and PPO Plans

When it comes to purchasing a health insurance plan, you’ve probably heard of the two plan types, HMO and PPO, but what exactly do these terms mean, and what is an EPO? Let’s learn more about these plan types and how you can choose the plan that meets your needs. What is an HMO Plan? HMO stands for “Health Maintenance Organization.” HMO plans contract with doctors and hospitals creating a network to provide health services for members in a specific area at lower rates, while also meeting quality standards. HMO plans typically require you to select a primary care physician (PCP) and obtain a referral from your PCP to see a specialist or to have certain tests done. If you choose to see a provider outside of the HMO’s network, the plan will not cover those services and you will be responsible for all charges. What is an EPO Plan? An EPO stands for “Exclusive Provider Organization.” This plan provides members with the opportunity to choose in-network providers within a broader network and to visit specialists without a referral from their primary care doctor. EPO plans offer a larger network than an HMO plan but typically do not have the out-of-network benefits of PPO plans. EPO plans do not require you to select a primary care physician (PCP) giving you a broader network of providers. EPO options are a great cost-saving option with more flexibility than a standard HMO plan. What is a PPO Plan? PPO stands for “Preferred Provider Organization.” PPO plans are often more flexible when it comes to choosing a doctor or a hospital. These plans still include a network of providers, but there are fewer restrictions on the providers you choose. PPO plans do not require you to select a primary care physician (PCP), giving you a broader network of providers. So, which plan should you choose? Each plan type has different benefits, so it depends on your health needs when choosing the right plan type. If you are looking for flexibility when choosing providers and locations, a PPO plan may better fit your needs. An EPO plan may be a better option if you want the flexibility of a larger network, but don’t necessarily need out-of-network benefits. If you regularly seek care in a certain geographic area and are looking for a health insurance plan at a lower price point, consider an HMO plan. To keep costs low, insurance carriers contract with providers and partner in plan members’ health to ensure quality care at the lowest cost. Whether you choose an HMO, EPO or PPO option, partnering with your health insurance carrier and your healthcare provider will help you receive the best care while controlling your out-of-pocket costs. Keep in mind that most insurance carriers offer emergency care coverage for all three plan options (HMO, PPO, EPO). Get the most out of your health insurance benefits! Established in 1988, Hometown Health is the insurance division of Renown Health and is northern Nevada’s largest and only locally-owned, not-for-profit insurance company providing wide-ranging medical coverage and great customer service to members.

Read More About Health Insurance Terms Explained: HMO, EPO and PPO Plans

-

Health Insurance Terms Explained: Deductible and Out-of-Pocket Maximum

Health insurance might be one of the most complicated purchases you will make throughout your life, so it is important to understand the terms and definitions insurance companies use. Keep these in mind as you are comparing health insurance plan options to choose the right plan for you and make the most of your health insurance benefits. One area of health insurance that can cause confusion is the difference between a plan's deductible and out-of-pocket maximum. They both represent points at which the insurance company starts paying for covered services, but what are they and how do they work? What is a deductible? A deductible is the dollar amount you pay to healthcare providers for covered services each year before insurance pays for services, other than preventive care. After you pay your deductible, you usually pay only a copayment (copay) or coinsurance for covered services. Your insurance company pays the rest. Generally, plans with lower monthly premiums have higher deductibles. Plans with higher monthly premiums usually have lower deductibles. What is the out-of-pocket maximum? An out-of-pocket maximum is the most you or your family will pay for covered services in a calendar year. It combines deductibles and cost-sharing costs (coinsurance and copays). The out-of-pocket maximum does not include costs you paid for insurance premiums, costs for not-covered services or services received out-of-network. Here's an example: You get into an accident and go to the emergency room. Your insurance policy has a $1,000 deductible and an out-of-pocket maximum of $4,500. You pay the $1,000 deductible to the hospital before your insurance company will pay for any of the covered services you need. If you received services at the hospital that exceed $1,000, the insurance company will pay the covered charges because you have met your deductible for the year. The $1,000 you paid goes toward your out-of-pocket maximum, leaving you with $3,500 left to pay on copays and coinsurance for the rest of the calendar year. If you need services at the emergency room or any other covered services in the future, you will still have to pay the copay or coinsurance amount included in your policy, which goes toward your out-of-pocket maximum. If you reach your out-of-pocket maximum, you will no longer pay copays or coinsurance and your insurance will pay for all of the covered services you require for the rest of the calendar year.

Read More About Health Insurance Terms Explained: Deductible and Out-of-Pocket Maximum

-

Copays vs. Coinsurance: Know the Difference

Health insurance is complicated, but you don't have to figure it out alone. Understanding terms and definitions is important when comparing health insurance plans. When you know more about health insurance, it can be much easier to make the right choice for you and your family. A common question when it comes to health insurance is, "Who pays for what?" Health insurance plans are very diverse and depending on your plan, you can have different types of cost-sharing: the cost of a medical visit or procedure an insured person shares with their insurance company. Two common examples of cost-sharing are copayments and coinsurance. You've likely heard both terms, but what are they and how are they different? Copayments Copayments (or copays) are typically a fixed dollar amount the insured person pays for their visit or procedure. They are a standard part of many health insurance plans and are usually collected for services like doctor visits or prescription drugs. For example: You go to the doctor because you are feeling sick. Your insurance policy states that you have a $20 copay for doctor office visits. You pay your $20 copay at the time of service and see the doctor. Coinsurance This is typically a percentage of the total cost of a visit or procedure. Like copays, coinsurance is a standard form of cost-sharing found in many insurance plans. For example: After a fall, you require crutches while you heal. Your coinsurance for durable medical equipment, like crutches, is 20% of the total cost. The crutches cost $50, so your insurance company will pay $40, or 80%, of the total cost. You will be billed $10 for your 20% coinsurance.

-

Patty Warren A Woman of Strength and Resilience

Meet and get to know Patty Warren, our featured Sterling Silver Club member this fall. You may recognize her from the latest Senior Care Plus commercial on television, where she joins a coffee chat discussing the many benefits of being a Senior Care Plus member. She’s one of the kindest souls you’ll ever meet – and has a positive outlook on life that we should all strive for. Patty's Story Patty was born and raised in a small Kansas town called Baxter Springs, where she grew up with an older brother, an older sister and two younger sisters. She and her siblings all enjoyed playing sports like softball and basketball, in addition to playing instruments. Patty developed a love and passion for music at a young age that carried into her adulthood. “I wanted to be an opera singer,” said Patty. “I decided to go to college at Pittsburg State University in Kansas where I majored in vocal performance.” After college, Patty moved to Manhattan in New York City to audition to be an opera singer, but she soon realized it wasn’t what she wanted to do after all. She eventually decided to work in the brokerage industry. After living and working in New York for three years, Patty moved back to Kansas where she later met the love of her life, Michael. “In 1992, I had put a dating ad in the local newspaper,” said Patty. “I received over 30 responses, and I went out on quite a few dates.” Then she had her first date with Michael, and the two of them quickly realized how much they liked each other. He asked her to marry him on Valentine’s Day in 1993, and they went on to get married in front of the Justice of the Peace on May 3, just a few months later. “We had a small wedding so that we could move into our first home together,” said Patty. A few years later in 1999, Patty and Michael moved to Arizona, where they lived for 22 years. Patty worked at Edward Jones Investments for 18 of those 22 years and loved her job and the people that she worked with. She retired in January 2021 during the pandemic, and three days later she and Michael moved to Sparks, Nevada.

Read More About Patty Warren A Woman of Strength and Resilience

-

3 Ways to Enroll in a Hometown Health Insurance Plan

Are you looking for health insurance coverage for the upcoming year? In that case, it's time to browse your options for an Individual or Family Plan. The Open Enrollment Period is from Nov. 1, 2023 until Dec 15, 2023. So, if you're looking for coverage by Jan 1, 2024, you must enroll by Dec 15, 2023. Get a Quote Online Suppose you don't qualify for a health insurance subsidy, no need to worry! You can still choose an individual and family health insurance plan from Hometown Health. Get a quote online by providing your location, the type of coverage you're looking for and your personal/family details. Once you've provided this information, you'll receive health plan options and pricing. And, if you find a plan you like, you can easily self-enroll online. Get Your Online Quote Today Enroll Through the Nevada Health Link Hometown Health offers Individual and Family health insurance plans on Nevada's Healthcare Marketplace, the Nevada Health Link. Through Nevada Health Link, eligible Nevada consumers can shop for, compare and purchase quality and affordable health insurance plans with ease. Nevada Health Link is the only health insurance resource that can provide eligible candidates with federal tax credits and subsidies to help cover the cost of your health insurance. Use Hometown Health's Insurance Subsidy Federal Poverty Level Calculator to see if you qualify for a tax credit or subsidy. Enroll via Nevada Health Link Work with a Health Insurance Broker Hometown Health is northern Nevada's local insurance provider and if you have questions about Individual and Family Plan insurance benefits, you’re in luck! Hometown Health partners with our local health insurance brokers who will work with you, typically at no cost, to help you understand health insurance plans and benefits and find the plan that is best for you. Need assistance finding a broker? Connect with our team by submitting the form below. They'll provide you with a list of our local broker partners. Find a Broker Near You

Read More About 3 Ways to Enroll in a Hometown Health Insurance Plan

-

Why I Give: Dan’s Story

In the fall of 2020, Dan's world was suddenly shaken when he received a distressing call: his son, Jeremy, was admitted to Renown with complications from spinal meningitis. Without a second thought, Dan rushed from Southern California to be by Jeremy's side. For an agonizing 10 days, Dan remained in the ICU. He was overwhelmed with worry and helplessness as Jeremy fought for his life on a ventilator. During this time, Dan, an esteemed artist and professor, found comfort in the collection of artworks adorning the walls at Renown. With more than 2,000 pieces of original art, Renown has meticulously curated hospital rooms, hallways and various spaces to support those in need. Dan, who talks about art's magic every day as a professor, experienced its power in a new light.

-

3 Unexpected Perks of Choosing a Hometown Health Plan

Becoming a Hometown Health plan member opens you up to the largest provider network in our region. As northern Nevada’s only not-for-profit health insurance company, the hometown advantage goes beyond your health coverage – and you may not be using all the perks available to you. Here are three benefits that Hometown Health is proud to offer all members to enhance wellbeing and connect the dots between healthcare and technology. MyChart MyChart is Renown Health's and Hometown Health’s secure online member portal that gives you direct access to your health and benefit information. From 24/7 access to your benefits and important documents to scheduling an appointment with your provider, this free tool is a great way to keep track of your family’s health. If you have a Renown primary care provider, you can use MyChart to: Securely email your healthcare provider. Get your test results faster and view your After Visit Summaries. Request prescription refills. Schedule and check-in for appointments. Pay your bill. Request your medical records and review immunization records. Manage designated health care agents and upload end-of-life documents, such as advance directives and a living will. View or download your documents: Member ID Card, Summary of Care, Explanation of Benefits, Referrals and Authorizations. Get in touch with our Customer Engagement Center. Telehealth Virtual visits have never been easier thanks to Renown Telehealth and Teladoc. These two tools are convenient options that allow members to be seen by a qualified doctor via phone or video chat who can diagnose, recommend treatment and prescribe medication for many non-emergent medical conditions – no matter where you are. Some of the health issues your virtual provider can treat include: Cold and flu Allergies Sore throat Sinus infection Respiratory infection Stomach bug Ear infection Urinary tract infection Both Renown Telehealth and Teladoc are also staffed with specialists in behavioral health, where you can speak with a therapist or psychiatrist on a wide variety of issues, including: Stress and anxiety Depression Trauma Grief Burnout Medication management Renown is also proud to offer access to top-level specialty care to address your ongoing condition and help guide you through illness maintenance and education. Through Renown Telehealth, Hometown Health members have access to a variety of specialties, including (but not limited to): Adolescent Medicine Cardiology Hematology, Oncology and Pediatric Oncology Nephrology Pediatric Endocrinology Pediatric Neurology Pulmonary and Pediatric Pulmonary Sleep Medicine New in recent years, Teladoc is now proud to offer both dermatology and nutrition visits. Teladoc dermatologists can treat conditions like acne, rosacea and rashes, while their registered dieticians can help you manage your nutrition and weight goals. Booking an appointment with Renown Telehealth is easy by heading over to MyChart and selecting “Schedule an Appointment.” To book an appointment with a Teladoc provider, visit teladoc.com or download the Teladoc app. Renown Telehealth is available within the state of Nevada, and Teladoc is available in all 50 states. Your copay can be as low as $0 for each visit; check your plan documents for more information. Doctoroo The house call has returned – avoid long urgent care waits with Doctoroo. Through Doctoroo, Hometown Health members have access to in-home urgent care services at the same price as your regular urgent care copay. A call to Doctoroo will dispatch a fully equipped medical team consisting of an EMT and either a nurse practitioner or physician assistant to your home within a few hours. Whether you need treatment or testing, each team is ready to provide care in the comfort of your own home with their over 60 medications and antibiotics, EKGs, wound dressings, IVs, catheters and more. Doctoroo care teams can address and treat many non-emergent care areas and conditions, including (but not limited to): Respiratory Ear, Nose, Throat Eye Wound Care Cardiac Care Musculoskeletal Gastroenterology Doctoroo is open year-round from 7 a.m. to midnight. Book a house call in minutes in the Doctoroo app or by calling (888) 888-9930.

Read More About 3 Unexpected Perks of Choosing a Hometown Health Plan

-

How Referrals Work at Hometown Health and Senior Care Plus

Your provider wants to send you to a specialist. Now what? You are about to enter the referral process. A referral is your provider’s recommendation for you to see a specialist or receive specialized treatment. When it comes to referrals, the process can seem like the wild west for people not familiar with it. At Hometown Health and Senior Care Plus, we make the process simple for all our members. We know that access to specialists is a vital aspect of total health, and our goal is to break down those barriers to care at every level. Here is a step-by-step guide to how the referral process with your Hometown Health or Senior Care Plus provider works: 1. Your primary care provider (PCP) or urgent care provider will send a referral to the specialist’s office. A referral can also be sent from another specialist or after discharge from the hospital. This is usually done via email or fax. 2. As your referral is sent, now would be the ideal time to discuss with your provider’s office how the specialist will receive your medical records prior to your appointment. Your provider’s office will most likely send these records to the specialist for you, but it is always a good idea to double-check with them directly. At Renown, the referrals team will send the following items to your specialist’s office when available: ID Insurance card Most recent and relevant office notes to support the referral The referral order Any relevant labs or imaging pertaining to the referral Demographics information 3. The specialist’s office will call you to schedule the appointment after they receive the referral. Each office processes the referrals they receive in a slightly different time frame, so if you have any questions about the status of your referral, it is best to call their office directly. At Renown, if you are enrolled in MyChart, you can access the phone number for your specialist as soon as the team processes the referral. Those not enrolled MyChart will receive a letter in the mail with scheduling information. 4. The specialist will start to develop a course of treatment. That may include procedures, diagnostic tests or medications. Some of these treatments may require prior authorization from your insurance plan, so don’t forget to discuss how and when your specialist will receive the authorizations before you begin your course of care to avoid any surprise bills. What can I expect if I have a Renown specialist? At Renown, we handle a lot of the behind-the-scenes nitty-gritty so you don’t have to. After the referral is placed, it routes to Renown’s centralized referrals team and triaged to make sure you are scheduled with one of our providers with the right specialization for your specialty care needs. This team will also obtain the prior authorization you need and will you to a specialist that is in your network and based on you and/or your provider’s preference and continuity of care. The referrals team will attempt to find you a Renown provider first if you are not yet established elsewhere. For Hometown Health and Senior Care Plus members, prior authorization is not required for certain services if you are being referred to a Renown provider. This makes the scheduling process go quicker for both the provider and the patient. Our referrals team strives to keep their turnaround time for referrals within three business days, not including prior authorization wait times. If your referral is marked as ‘urgent,’ it will be reviewed within one business day so you are seen as soon as possible based on the needs of your medical condition, and you will receive a direct phone call with scheduling information. After prior authorization is obtained, the Renown scheduling team will call you through an automated phone system or via a message in MyChart with a direct link to schedule your appointment. To speak with a Renown scheduler or if you have any questions, please call 775-982-5000. What does prior authorization mean? Prior authorization isn’t as scary as it sounds! Essentially, prior authorization is your provider “going to bat” for you to receive this specialty level of care. Some medical services, including many specialists, are covered only if your ordering provider (usually your PCP) submits an authorization request to your insurance plan. They will include specific details about the type and duration of treatment they would like you to receive and any medical records that support your need for the specialist. After your insurer receives the request, a licensed medical professional will review the request, your records and your plan benefits. They will decide whether the specialty treatment is considered medically necessary based on recognized standards of care. Where can I go for more information? Your referrals and authorizations can be viewed in MyChart. To view them, navigate to Your Menu in the upper left corner of the page, scroll to the Insurance section and click on “Referrals.” The Renown referrals team is available to answer your questions and address any concerns. Give them a call at 775-982-2707 Monday through Friday from 8 a.m. to 5 p.m. Any questions you may have related to referrals and authorizations, including outside-of-Renown providers, can be directed to our expert Hometown Health or Senior Care Plus customer engagement representatives.

Read More About How Referrals Work at Hometown Health and Senior Care Plus