Buscar

-

How to Protect Your Kids from Heatstroke

Summer is around the corner, bringing heightened risks of heatstroke, especially for children who cannot regulate their body temperature as efficiently as adults. Infants are particularly vulnerable and may not express discomfort, so never leave a child unattended in a vehicle. Top Tips for Preventing Heatstroke Reduce the number of deaths from heatstroke by remembering to ACT. Avoid heatstroke-related injury and death by never leaving a child alone in a car, not even for a minute. And make sure to keep your car locked when you’re not inside so kids don’t get in on their own. Create reminders. Keep a stuffed animal or other memento in your child’s car seat when it’s empty, and move it to the front seat as a visual reminder when your child is in the back seat. Or place and secure your phone, briefcase or purse in the backseat when traveling with your child. Take action. If you see a child alone in a car, call 911. Emergency personnel want you to call. They are trained to respond to these situations Keeping Your Baby Cool in the Back Seat In hot weather, it is crucial to keep your baby cool and hydrated by using a car seat cover or towel over them to reflect the sun's rays. Dress your baby in lightweight clothing that covers their arms and legs. Keep an eye on your baby's skin color. Move them to a cooler place if they look too red or flushed. Keep the temperature at a comfortable temperature for you, not for your child. Keep the windows cracked open for ventilation and ensure nothing is blocking the airflow from entering or exiting the vehicle. Dress your infant appropriately for their environment, including appropriate head and neck coverings, to keep them cool and protected from sunburns. Ensure you have enough fluids to last an hour before getting out of the car or use bottled water if possible. Never leave your child unattended in a car. Steps to Follow if You Suspect Heatstroke Call 911 immediately. Cool the victim – Get the person to a shady area, remove restrictive clothing and cover skin with sheets soaked in ice-water, and place ice packs in the arm pits and groin. Have the victim drink cool fluids, preferably an electrolyte-containing sports drink. Monitor body temperature with a thermometer but stop cooling efforts after temperature has dropped to 102 Fahrenheit. Baby Safe Classes These classes help prepare parents for emergencies that may occur in baby’s first year. Safe Kids Worldwide Did you know heatstroke is the leading cause of non-crash related fatalities in children? “On average, every 10 days a child dies from heatstroke in a vehicle. In more than half of these deaths, the caregiver forgot the child was in the car.”

-

Prevenir el cáncer de piel Consejos de una médica

Want to protect yourself from skin damage from the sun’s harmful rays? Dr. Angela Walker, dermatologist with Renown Medical Group, shares what you can do to prevent skin cancer. What can people do to prevent skin cancer while enjoying the outdoors? There are several steps you can take to protect your skin from the sun. “I caution all of my patients to avoid the sun during the hours of 10 a.m. until 2 p.m. when UV rays are strongest. I also encourage people to wear sleeves on cooler days. And don’t forget that we still need to wear sunscreen on cloudy days! UV rays can still cause sun damage on cloudy days. Preventing skin cancer also entails wearing sunscreen of at least SPF 30 everyday. Are hats also a good idea for skin protection? Yes, of course! Choose a wide-brim hat that shades the face as well as the back of the neck for extra protection against UV rays. When it comes to identifying skin cancer, what should people watch for? We use easy-to-remember letters when checking for spots on the skin; it’s called the ABCDEs: A - Asymmetry: One half of the mole or lesion doesn't match the other half. B - Border irregularity: The edges of the mole are irregular, blurred, or notched. C - Color variation: The mole has different shades of color or uneven color distribution. D - Diameter: The diameter of the mole is larger than the size of a pencil eraser (about 6 millimeters) or is increasing in size. E - Evolution: Any changes in the mole over time, such as size, shape, color, itching, bleeding, or crusting. These guidelines can help in identifying potentially suspicious skin lesions, but it's important to consult a dermatologist for proper evaluation and diagnosis. Early detection is crucial for successful treatment of skin cancer.

-

Are You Using the Right Sunscreen?

Seeking protection for yourself and your loved ones from the intense sun rays at northern Nevada's elevated altitudes? With so many choices available, selecting the ideal sunscreen can be daunting. To guide you through this, we consulted Dr. Angela Walker, a dermatologist from Renown Medical Group, for her expert insights. Sunscreen Application Dermatologists recommend a broad-spectrum sunscreen with a minimum SPF of 30, but keep in mind that no sunscreen protects against 100 percent of UV radiation and that reapplication is necessary. “No matter the SPF, sunscreen must be applied adequately and frequently, meaning a quarter-sized amount to cover the face and neck and a full shot glass amount for the body when wearing a bathing suit,” said Walker. “Reapplication should be every 80 minutes.” Why not use a high SPF, such as 70 or 100? According to the Skin Cancer Foundation, they don’t offer significantly more protection than SPF 30 and mislead people into thinking they have a higher level of protection. Here’s the breakdown: SPF 15 blocks 93 percent of UVB rays SPF 30 blocks 97 percent of UVB rays SPF 50 blocks 98 percent of UVB rays SPF 100 blocks 99 percent of UVB rays Do specific populations require a higher SPF? Walker explains that infants, seniors, and those with a history of skin cancer must take precautions against UV radiation, as their skin is vulnerable. Sunscreen should be an absolute priority before spending time outdoors and avoiding prolonged sun exposure, wearing a hat with wide brim (recommended 4-inch brim) and UPF (ultraviolet protection factor) clothing. Due to the sensitive nature of an infant’s skin, babies under six months should not spend time in the direct sun. For infants and toddlers six months and older, whose skin is thinner than adults, a sunscreen that contains zinc oxide or titanium dioxide (physical protectors) should be applied. Zinc and titanium are less likely to irritate because they do not penetrate the skin and instead sit on the surface and deflect UV radiation. Zinc oxide and titanium dioxide are vital ingredients to seek out in sunscreen due to their strong ability to deflect UV radiation. Sunscreen Terms Explained UVA = Long wave ultraviolet light. Penetrates deep into the dermis, the skin’s thickest layer, causing tissue damage that wrinkles and photo-aging and contributes to developing skin cancer. UVB = Short wave ultraviolet light. The biggest contributor to the development of skin cancer and are more prevalent during mid-day. SPF = Sun protection factor. Calculated by comparing the amount of time needed to burn sunscreen-protected skin vs. unprotected skin. So, SPF 15 means you can stay in the sun 15 times longer than you could without protection.

-

Health Insurance Terms Explained: HMO, EPO and PPO Plans

When it comes to purchasing a health insurance plan, you’ve probably heard of the two plan types, HMO and PPO, but what exactly do these terms mean, and what is an EPO? Let’s learn more about these plan types and how you can choose the plan that meets your needs. What is an HMO Plan? HMO stands for “Health Maintenance Organization.” HMO plans contract with doctors and hospitals creating a network to provide health services for members in a specific area at lower rates, while also meeting quality standards. HMO plans typically require you to select a primary care physician (PCP) and obtain a referral from your PCP to see a specialist or to have certain tests done. If you choose to see a provider outside of the HMO’s network, the plan will not cover those services and you will be responsible for all charges. What is an EPO Plan? An EPO stands for “Exclusive Provider Organization.” This plan provides members with the opportunity to choose in-network providers within a broader network and to visit specialists without a referral from their primary care doctor. EPO plans offer a larger network than an HMO plan but typically do not have the out-of-network benefits of PPO plans. EPO plans do not require you to select a primary care physician (PCP) giving you a broader network of providers. EPO options are a great cost-saving option with more flexibility than a standard HMO plan. What is a PPO Plan? PPO stands for “Preferred Provider Organization.” PPO plans are often more flexible when it comes to choosing a doctor or a hospital. These plans still include a network of providers, but there are fewer restrictions on the providers you choose. PPO plans do not require you to select a primary care physician (PCP), giving you a broader network of providers. So, which plan should you choose? Each plan type has different benefits, so it depends on your health needs when choosing the right plan type. If you are looking for flexibility when choosing providers and locations, a PPO plan may better fit your needs. An EPO plan may be a better option if you want the flexibility of a larger network, but don’t necessarily need out-of-network benefits. If you regularly seek care in a certain geographic area and are looking for a health insurance plan at a lower price point, consider an HMO plan. To keep costs low, insurance carriers contract with providers and partner in plan members’ health to ensure quality care at the lowest cost. Whether you choose an HMO, EPO or PPO option, partnering with your health insurance carrier and your healthcare provider will help you receive the best care while controlling your out-of-pocket costs. Keep in mind that most insurance carriers offer emergency care coverage for all three plan options (HMO, PPO, EPO). Get the most out of your health insurance benefits! Established in 1988, Hometown Health is the insurance division of Renown Health and is northern Nevada’s largest and only locally-owned, not-for-profit insurance company providing wide-ranging medical coverage and great customer service to members.

Read More About Health Insurance Terms Explained: HMO, EPO and PPO Plans

-

Health Insurance Terms Explained: Deductible and Out-of-Pocket Maximum

Health insurance might be one of the most complicated purchases you will make throughout your life, so it is important to understand the terms and definitions insurance companies use. Keep these in mind as you are comparing health insurance plan options to choose the right plan for you and make the most of your health insurance benefits. One area of health insurance that can cause confusion is the difference between a plan's deductible and out-of-pocket maximum. They both represent points at which the insurance company starts paying for covered services, but what are they and how do they work? What is a deductible? A deductible is the dollar amount you pay to healthcare providers for covered services each year before insurance pays for services, other than preventive care. After you pay your deductible, you usually pay only a copayment (copay) or coinsurance for covered services. Your insurance company pays the rest. Generally, plans with lower monthly premiums have higher deductibles. Plans with higher monthly premiums usually have lower deductibles. What is the out-of-pocket maximum? An out-of-pocket maximum is the most you or your family will pay for covered services in a calendar year. It combines deductibles and cost-sharing costs (coinsurance and copays). The out-of-pocket maximum does not include costs you paid for insurance premiums, costs for not-covered services or services received out-of-network. Here's an example: You get into an accident and go to the emergency room. Your insurance policy has a $1,000 deductible and an out-of-pocket maximum of $4,500. You pay the $1,000 deductible to the hospital before your insurance company will pay for any of the covered services you need. If you received services at the hospital that exceed $1,000, the insurance company will pay the covered charges because you have met your deductible for the year. The $1,000 you paid goes toward your out-of-pocket maximum, leaving you with $3,500 left to pay on copays and coinsurance for the rest of the calendar year. If you need services at the emergency room or any other covered services in the future, you will still have to pay the copay or coinsurance amount included in your policy, which goes toward your out-of-pocket maximum. If you reach your out-of-pocket maximum, you will no longer pay copays or coinsurance and your insurance will pay for all of the covered services you require for the rest of the calendar year.

Read More About Health Insurance Terms Explained: Deductible and Out-of-Pocket Maximum

-

Copays vs. Coinsurance: Know the Difference

Health insurance is complicated, but you don't have to figure it out alone. Understanding terms and definitions is important when comparing health insurance plans. When you know more about health insurance, it can be much easier to make the right choice for you and your family. A common question when it comes to health insurance is, "Who pays for what?" Health insurance plans are very diverse and depending on your plan, you can have different types of cost-sharing: the cost of a medical visit or procedure an insured person shares with their insurance company. Two common examples of cost-sharing are copayments and coinsurance. You've likely heard both terms, but what are they and how are they different? Copayments Copayments (or copays) are typically a fixed dollar amount the insured person pays for their visit or procedure. They are a standard part of many health insurance plans and are usually collected for services like doctor visits or prescription drugs. For example: You go to the doctor because you are feeling sick. Your insurance policy states that you have a $20 copay for doctor office visits. You pay your $20 copay at the time of service and see the doctor. Coinsurance This is typically a percentage of the total cost of a visit or procedure. Like copays, coinsurance is a standard form of cost-sharing found in many insurance plans. For example: After a fall, you require crutches while you heal. Your coinsurance for durable medical equipment, like crutches, is 20% of the total cost. The crutches cost $50, so your insurance company will pay $40, or 80%, of the total cost. You will be billed $10 for your 20% coinsurance.

-

COPD Explained: Protecting Your Lungs and Managing Symptoms

COPD (chronic obstructive pulmonary disease) is a progressive lung condition often mistaken for typical aging signs, like shortness of breath and coughing. While smoking and pollution can contribute to its development, lifestyle changes and medications can help manage its progression. Diagnosis typically involves lung function tests, chest X-rays, or CT scans, with treatments available through a pulmonologist or primary care provider. Renown’s Pulmonary Rehabilitation Program offers insights into living with COPD. What is COPD? According to the COPD Foundation, it is an umbrella term used to describe progressive lung diseases including: Emphysema: Damage to the small air sacs in the lungs (alveoli). Chronic Bronchitis: Irritation and swelling of bronchial tubes, causing shortness of breath and coughing for long periods of time. Asthma (non-reversible): When asthma medications cannot reduce swelling in the airways. COPD Risk Factors Smoking is the most significant COPD risk factor, and the American Lung Association (ALA) says it accounts for nearly 90 percent of cases. If you are a smoker, it is essential to seek help and quit. Other COPD risk factors include: Air pollution Genetics Second-hand smoke Chemical, fumes or dust in the workplace How Can You Protect Yourself? Stop smoking Renown Health provides support offering 4-week Smoking Cessation Virtual Classes, free of charge! Sign up today. Use natural cleaning products Many household chemicals, especially those containing bleach, can irritate the lungs – a condition called, chemical pneumonitis. Stay away from all types of smoke This includes smoke from fireplaces. Likewise, plan to stay indoors when it is smoky outside, or air quality is poor. Get active Of course, it’s never too late to start an exercise program. When exercising your heart pumps, circulating your blood and sending oxygen to every part of your body. Notably it strengthens your lungs, making it easier to breath. Talk to your doctor to see if you are healthy enough to begin exercising. Eat a healthy diet Surprisingly what you eat can affect your breathing. The American Lung Association encourages those with COPD to watch their sodium intake, eat smaller, more frequent meals (instead of three large ones), limit high fat foods and drink plenty of water. Avoid scented products Perfumes, aerosol sprays and plug-in air fresheners can trigger flare-ups. Get a flu shot Did you know chronic lung conditions, as well as, heart disease, cancer and diabetes, can be made even worse by the flu? Now is the time to get your flu shot for the season if you haven’t already. Renown’s Pulmonary Rehab staff is certified through the American Association for Cardiovascular and Pulmonary Rehabilitation (AACVPR). Recently, Renown Regional Medical Center successfully completed a disease specific COPD certification survey by The Joint Commission. For two accreditation cycles in a row, the COPD Program has had zero findings during the rigorous survey.

Read More About COPD Explained: Protecting Your Lungs and Managing Symptoms

-

3 Ways to Enroll in a Hometown Health Insurance Plan

Are you looking for health insurance coverage for the upcoming year? In that case, it's time to browse your options for an Individual or Family Plan. The Open Enrollment Period is from Nov. 1, 2023 until Dec 15, 2023. So, if you're looking for coverage by Jan 1, 2024, you must enroll by Dec 15, 2023. Get a Quote Online Suppose you don't qualify for a health insurance subsidy, no need to worry! You can still choose an individual and family health insurance plan from Hometown Health. Get a quote online by providing your location, the type of coverage you're looking for and your personal/family details. Once you've provided this information, you'll receive health plan options and pricing. And, if you find a plan you like, you can easily self-enroll online. Get Your Online Quote Today Enroll Through the Nevada Health Link Hometown Health offers Individual and Family health insurance plans on Nevada's Healthcare Marketplace, the Nevada Health Link. Through Nevada Health Link, eligible Nevada consumers can shop for, compare and purchase quality and affordable health insurance plans with ease. Nevada Health Link is the only health insurance resource that can provide eligible candidates with federal tax credits and subsidies to help cover the cost of your health insurance. Use Hometown Health's Insurance Subsidy Federal Poverty Level Calculator to see if you qualify for a tax credit or subsidy. Enroll via Nevada Health Link Work with a Health Insurance Broker Hometown Health is northern Nevada's local insurance provider and if you have questions about Individual and Family Plan insurance benefits, you’re in luck! Hometown Health partners with our local health insurance brokers who will work with you, typically at no cost, to help you understand health insurance plans and benefits and find the plan that is best for you. Need assistance finding a broker? Connect with our team by submitting the form below. They'll provide you with a list of our local broker partners. Find a Broker Near You

Read More About 3 Ways to Enroll in a Hometown Health Insurance Plan

-

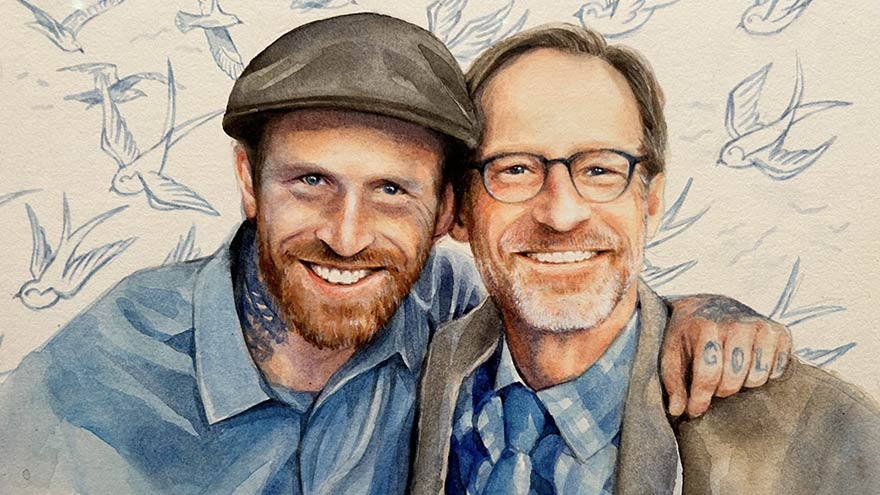

Why I Give: Dan’s Story

In the fall of 2020, Dan's world was suddenly shaken when he received a distressing call: his son, Jeremy, was admitted to Renown with complications from spinal meningitis. Without a second thought, Dan rushed from Southern California to be by Jeremy's side. For an agonizing 10 days, Dan remained in the ICU. He was overwhelmed with worry and helplessness as Jeremy fought for his life on a ventilator. During this time, Dan, an esteemed artist and professor, found comfort in the collection of artworks adorning the walls at Renown. With more than 2,000 pieces of original art, Renown has meticulously curated hospital rooms, hallways and various spaces to support those in need. Dan, who talks about art's magic every day as a professor, experienced its power in a new light.

-

Winter Skin Care: 5 Must-Know Pro Tips

As the seasons shift, so do the demands of our skin. We sat down with Heidi Nicol, a seasoned aesthetician at Renown Dermatology, Laser & Skin Care, to uncover the secrets of pampering your skin during the winter onset. The aftermath of summer often leaves us with dry, dull skin and unexpected breakouts. However, a few tweaks to your skincare regimen can make this seasonal transition smoother. 1. Re-evaluate Your Cleanser Now might be the opportune moment to transition to a non-drying cleanser. The one that worked wonders in the summer might be aggressive for the colder months. Nicol suggests opting for a "gentle" cleanser that effectively cleanses and exfoliates without including abrasive ingredients. 2. Amp Up the Hydration With the dip in temperature, your skin craves a richer moisturizer. Seek out products enriched with Hyaluronic Acid. This powerhouse ingredient amplifies your skin's ability to retain moisture, ensuring it stays supple throughout the day. 3. Introduce Retinol If retinol isn't a staple in your skincare arsenal yet, consider introducing it now. Its prowess in diminishing sun-induced brown spots and fine lines is unparalleled.

-

Celebrating World Lung Day in Northern Nevada

In the United States, electronic cigarettes are the most popular form of tobacco product used among high school students. Approximately 21% of Washoe County area high schoolers report current use of e-cigarettes, higher than the national average of 14% reported in the most recent national data. While often viewed as a safer alternative to traditional cigarette use, e-cigarette use, commonly referred to as vaping, exposes users to nicotine and harmful chemicals that stunt brain development, results in lung damage and harms overall health. In partnership with Reno area school principals and nurses, the Renown Health – UNR Med Clinical Research Office was able to provide this year’s World Lung Day Anti-Vaping Program to Galena High School, Robert McQueen High School and Sage Ridge School, reaching hundreds of high school students.

Read More About Celebrating World Lung Day in Northern Nevada

-

3 Unexpected Perks of Choosing a Hometown Health Plan

© AndreyPopov via Canva.com Becoming a Hometown Health plan member opens you up to the largest provider network in our region. As northern Nevada’s only not-for-profit health insurance company, the hometown advantage goes beyond your health coverage – and you may not be using all the perks available to you. Here are three benefits that Hometown Health is proud to offer all members to enhance wellbeing and connect the dots between healthcare and technology. MyChart MyChart is Renown Health's and Hometown Health’s secure online member portal that gives you direct access to your health and benefit information. From 24/7 access to your benefits and important documents to scheduling an appointment with your provider, this free tool is a great way to keep track of your family’s health. If you have a Renown primary care provider, you can use MyChart to: Securely email your healthcare provider. Get your test results faster and view your After Visit Summaries. Request prescription refills. Schedule and check-in for appointments. Pay your bill. Request your medical records and review immunization records. Manage designated health care agents and upload end-of-life documents, such as advance directives and a living will. View or download your documents: Member ID Card, Summary of Care, Explanation of Benefits, Referrals and Authorizations. Get in touch with our Customer Engagement Center. Telehealth Virtual visits have never been easier thanks to Renown Telehealth and Teladoc. These two tools are convenient options that allow members to be seen by a qualified doctor via phone or video chat who can diagnose, recommend treatment and prescribe medication for many non-emergent medical conditions – no matter where you are. Some of the health issues your virtual provider can treat include: Cold and flu Allergies Sore throat Sinus infection Respiratory infection Stomach bug Ear infection Urinary tract infection Both Renown Telehealth and Teladoc are also staffed with specialists in behavioral health, where you can speak with a therapist or psychiatrist on a wide variety of issues, including: Stress and anxiety Depression Trauma Grief Burnout Medication management Renown is also proud to offer access to top-level specialty care to address your ongoing condition and help guide you through illness maintenance and education. Through Renown Telehealth, Hometown Health members have access to a variety of specialties, including (but not limited to): Adolescent Medicine Cardiology Hematology, Oncology and Pediatric Oncology Nephrology Pediatric Endocrinology Pediatric Neurology Pulmonary and Pediatric Pulmonary Sleep Medicine New in recent years, Teladoc is now proud to offer both dermatology and nutrition visits. Teladoc dermatologists can treat conditions like acne, rosacea and rashes, while their registered dieticians can help you manage your nutrition and weight goals. Booking an appointment with Renown Telehealth is easy by heading over to MyChart and selecting “Schedule an Appointment.” To book an appointment with a Teladoc provider, visit teladoc.com or download the Teladoc app. Renown Telehealth is available within the state of Nevada, and Teladoc is available in all 50 states. Your copay can be as low as $0 for each visit; check your plan documents for more information. Doctoroo The house call has returned – avoid long urgent care waits with Doctoroo. Through Doctoroo, Hometown Health members have access to in-home urgent care services at the same price as your regular urgent care copay. A call to Doctoroo will dispatch a fully equipped medical team consisting of an EMT and either a nurse practitioner or physician assistant to your home within a few hours. Whether you need treatment or testing, each team is ready to provide care in the comfort of your own home with their over 60 medications and antibiotics, EKGs, wound dressings, IVs, catheters and more. Doctoroo care teams can address and treat many non-emergent care areas and conditions, including (but not limited to): Respiratory Ear, Nose, Throat Eye Wound Care Cardiac Care Musculoskeletal Gastroenterology Doctoroo is open year-round from 7 a.m. to midnight. Book a house call in minutes in the Doctoroo app or by calling (888) 888-9930.

Read More About 3 Unexpected Perks of Choosing a Hometown Health Plan