Buscar

-

3,000 Miles Away But Close to Home

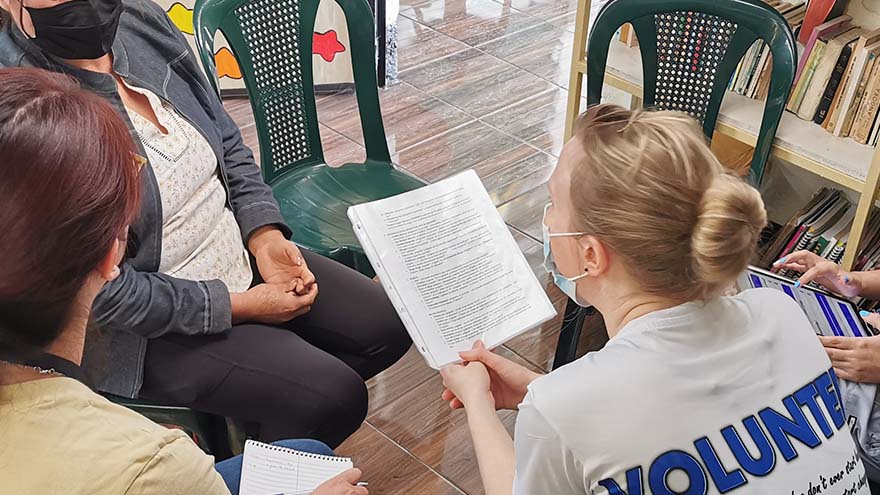

Overcoming poverty is not a task of charity, it is an act of justice. Like slavery and apartheid, poverty is not natural. It is man-made and can overcome by the actions of human beings. Sometimes it falls on a generation to be great. You can be that great generation. Let your greatness bloom. – Nelson Mandela, February 2005, Make Poverty History Campaign in London Lifting away the curtain that symbolized the front door, I entered a dark, cinderblock room and instantly became overwhelmed by an unpleasant odor. Working with oncology patients as a Child Life Specialist and an Occupational Therapist for over ten years, I recognized that smell. I had arrived in Guatemala – more than 3,000 miles from Reno – and it was my first day of a week-long trip where I would be serving alongside physicians in low-income communities providing free medical care for residents. My name is Brittany Jemmoua, I am an occupational therapist at Renown, and I recently volunteered with Kalan Kuxtal, a non-profit Guatemalan organization. I served alongside physicians by providing free primary care mobile clinics and home visits. The care we provided focused on prevention, intervention, education and lifestyle/medication management as we partnered with local entities, such as fire stations, community centers and schools to transform hundreds of lives. Speaking in both English and Spanish, I collected patient intake information, performed exams, tested for diabetes, and collaborated on a diabetes research project focused on daily risk assessment. Beyond these tasks, I immersed myself in the culture and learned more from the Guatemalan people than I could have ever imagined. Similar to Renown, Kalan Kuxtal Operates with Community at its Core Kalan Kuxtal, a Mayan expression meaning “life guardian,” is different from other volunteer medical trip organizations, and I took home valuable insights and lessons from their way of life that I now consider daily in my practice at Renown. I expanded my knowledge about diabetes, hypertension, pharmacology, infectious diseases, pregnancy complication, vector-borne illness and tuberculosis. We conducted home visits for socially neglected populations rather than expecting everyone to come to our clinics. I found that being welcomed into people’s homes gives you a different lens in which to view how their medical diagnoses interact with living conditions, occupations, and quality of life. This is when I met Mercedes and her mom. Her mom, Ms. Valencia, had jaundice skin and a substantial Basal Cell Carcinoma aggressively protruding from her face that impacted eating, hearing, seeing, sleep and social interactions. This opportunity to serve within their home led to an important palliative care conversation that would have been missed had we stayed in the clinic. We combed the rural neighborhoods assessing people’s risk for diabetes, taking glucose tests and educating families about their next steps. Many individuals had uncontrolled diabetes and misunderstandings regarding basic health management strategies. At the end of the day, many people demonstrated feelings of empowerment by actively offering solutions regarding how they will manage their day-to-day glucose with diet and exercise. Small actions can lead to big changes, and in the long-term, these health actions can help them avoid medication costs and focus on affording basic life necessities, such as water and electricity. Kalan Kuxtal organized a cultural day that included going to local businesses and community leaders to learn more about how they support the people of Guatemala. For example, Valhalla Macadamia Farm’s main goal is to help communities gain access to income, employment, and improved wellbeing by donating macadamia trees to families to grow and then sell macadamia products. A Weeklong Trip with Lifelong Impacts Each patient made a lasting impact on me, both personally and professionally. One specific family I saw in the clinic had a unique situation in that their two-year-old daughter, Margareth Elizabeth Cifuentes Bautista, was laboriously diagnosed with irregular corneal syndrome associated with glaucoma of congenital origin. Due to Guatemala’s limited prenatal screens and interventions, Elizabeth is nearly blind. While highly spirited and happy, she trips, bumps and feels her way through life. One barrier to her healthcare access is that her hard-working parents remain well below the poverty line, making less than $900/month. I am working to connect them with generous US Ophthalmologists and pediatric eye specialists to explore how we might save her sight and help her family. Their biggest dream is that she could recover her eyesight. “I know that this is not a life-threatening situation, but it is still something that never stops hurting me,” Jorge Cifuentes, Elizabeth’s father, said. “Unfortunately, our situation here is very hard. This country [Guatemala], although beautiful, it is very difficult to get ahead. We are people living in underprivileged conditions which complicates our situation even more. However, we are still trying to thrive by being kind and hardworking people. Thank you for helping us.” I have had the privilege of an opportunity for education, access to healthcare, employment and am aware that inequity and injustice prevail. This experience reinforced my understanding that medicine is a physically and mentally demanding profession that requires a commitment to service, continuous learning and adaptation both on local and global scales. I encourage everyone to please join me in serving the underserved by volunteering. Brittany is an experienced Occupational Therapist at Renown and volunteers with Kalan Kuxtal and other entities, such as The Robert Unsworth Foundation and Rock Steady Boxing to elevate communities. She loves being an Occupational Therapist; however, her life experiences confirm that her true calling is to become a physician. She is currently applying to medical school. Brittany is eager to earn the responsibility to improve lives and communities as their engaged physician. Brittany is tentatively scheduled to return to Guatemala at the end of this year to continue partnering with the people for a better future. You are welcome to join!

-

3 Ways to Enroll in a Hometown Health Insurance Plan

Are you looking for health insurance coverage for the upcoming year? In that case, it's time to browse your options for an Individual or Family Plan. The Open Enrollment Period is from Nov. 1, 2023 until Dec 15, 2023. So, if you're looking for coverage by Jan 1, 2024, you must enroll by Dec 15, 2023. Get a Quote Online Suppose you don't qualify for a health insurance subsidy, no need to worry! You can still choose an individual and family health insurance plan from Hometown Health. Get a quote online by providing your location, the type of coverage you're looking for and your personal/family details. Once you've provided this information, you'll receive health plan options and pricing. And, if you find a plan you like, you can easily self-enroll online. Get Your Online Quote Today Enroll Through the Nevada Health Link Hometown Health offers Individual and Family health insurance plans on Nevada's Healthcare Marketplace, the Nevada Health Link. Through Nevada Health Link, eligible Nevada consumers can shop for, compare and purchase quality and affordable health insurance plans with ease. Nevada Health Link is the only health insurance resource that can provide eligible candidates with federal tax credits and subsidies to help cover the cost of your health insurance. Use Hometown Health's Insurance Subsidy Federal Poverty Level Calculator to see if you qualify for a tax credit or subsidy. Enroll via Nevada Health Link Work with a Health Insurance Broker Hometown Health is northern Nevada's local insurance provider and if you have questions about Individual and Family Plan insurance benefits, you’re in luck! Hometown Health partners with our local health insurance brokers who will work with you, typically at no cost, to help you understand health insurance plans and benefits and find the plan that is best for you. Need assistance finding a broker? Connect with our team by submitting the form below. They'll provide you with a list of our local broker partners. Find a Broker Near You

Read More About 3 Ways to Enroll in a Hometown Health Insurance Plan

-

Health Insurance Terms Explained: HMO, EPO and PPO Plans

When it comes to purchasing a health insurance plan, you’ve probably heard of the two plan types, HMO and PPO, but what exactly do these terms mean, and what is an EPO? Let’s learn more about these plan types and how you can choose the plan that meets your needs. What is an HMO Plan? HMO stands for “Health Maintenance Organization.” HMO plans contract with doctors and hospitals creating a network to provide health services for members in a specific area at lower rates, while also meeting quality standards. HMO plans typically require you to select a primary care physician (PCP) and obtain a referral from your PCP to see a specialist or to have certain tests done. If you choose to see a provider outside of the HMO’s network, the plan will not cover those services and you will be responsible for all charges. What is an EPO Plan? An EPO stands for “Exclusive Provider Organization.” This plan provides members with the opportunity to choose in-network providers within a broader network and to visit specialists without a referral from their primary care doctor. EPO plans offer a larger network than an HMO plan but typically do not have the out-of-network benefits of PPO plans. EPO plans do not require you to select a primary care physician (PCP) giving you a broader network of providers. EPO options are a great cost-saving option with more flexibility than a standard HMO plan. What is a PPO Plan? PPO stands for “Preferred Provider Organization.” PPO plans are often more flexible when it comes to choosing a doctor or a hospital. These plans still include a network of providers, but there are fewer restrictions on the providers you choose. PPO plans do not require you to select a primary care physician (PCP), giving you a broader network of providers. So, which plan should you choose? Each plan type has different benefits, so it depends on your health needs when choosing the right plan type. If you are looking for flexibility when choosing providers and locations, a PPO plan may better fit your needs. An EPO plan may be a better option if you want the flexibility of a larger network, but don’t necessarily need out-of-network benefits. If you regularly seek care in a certain geographic area and are looking for a health insurance plan at a lower price point, consider an HMO plan. To keep costs low, insurance carriers contract with providers and partner in plan members’ health to ensure quality care at the lowest cost. Whether you choose an HMO, EPO or PPO option, partnering with your health insurance carrier and your healthcare provider will help you receive the best care while controlling your out-of-pocket costs. Keep in mind that most insurance carriers offer emergency care coverage for all three plan options (HMO, PPO, EPO). Get the most out of your health insurance benefits! Established in 1988, Hometown Health is the insurance division of Renown Health and is northern Nevada’s largest and only locally-owned, not-for-profit insurance company providing wide-ranging medical coverage and great customer service to members.

Read More About Health Insurance Terms Explained: HMO, EPO and PPO Plans

-

Health Insurance Terms Explained: Deductible and Out-of-Pocket Maximum

Health insurance might be one of the most complicated purchases you will make throughout your life, so it is important to understand the terms and definitions insurance companies use. Keep these in mind as you are comparing health insurance plan options to choose the right plan for you and make the most of your health insurance benefits. One area of health insurance that can cause confusion is the difference between a plan's deductible and out-of-pocket maximum. They both represent points at which the insurance company starts paying for covered services, but what are they and how do they work? What is a deductible? A deductible is the dollar amount you pay to healthcare providers for covered services each year before insurance pays for services, other than preventive care. After you pay your deductible, you usually pay only a copayment (copay) or coinsurance for covered services. Your insurance company pays the rest. Generally, plans with lower monthly premiums have higher deductibles. Plans with higher monthly premiums usually have lower deductibles. What is the out-of-pocket maximum? An out-of-pocket maximum is the most you or your family will pay for covered services in a calendar year. It combines deductibles and cost-sharing costs (coinsurance and copays). The out-of-pocket maximum does not include costs you paid for insurance premiums, costs for not-covered services or services received out-of-network. Here's an example: You get into an accident and go to the emergency room. Your insurance policy has a $1,000 deductible and an out-of-pocket maximum of $4,500. You pay the $1,000 deductible to the hospital before your insurance company will pay for any of the covered services you need. If you received services at the hospital that exceed $1,000, the insurance company will pay the covered charges because you have met your deductible for the year. The $1,000 you paid goes toward your out-of-pocket maximum, leaving you with $3,500 left to pay on copays and coinsurance for the rest of the calendar year. If you need services at the emergency room or any other covered services in the future, you will still have to pay the copay or coinsurance amount included in your policy, which goes toward your out-of-pocket maximum. If you reach your out-of-pocket maximum, you will no longer pay copays or coinsurance and your insurance will pay for all of the covered services you require for the rest of the calendar year.

Read More About Health Insurance Terms Explained: Deductible and Out-of-Pocket Maximum

-

Copays vs. Coinsurance: Know the Difference

Health insurance is complicated, but you don't have to figure it out alone. Understanding terms and definitions is important when comparing health insurance plans. When you know more about health insurance, it can be much easier to make the right choice for you and your family. A common question when it comes to health insurance is, "Who pays for what?" Health insurance plans are very diverse and depending on your plan, you can have different types of cost-sharing: the cost of a medical visit or procedure an insured person shares with their insurance company. Two common examples of cost-sharing are copayments and coinsurance. You've likely heard both terms, but what are they and how are they different? Copayments Copayments (or copays) are typically a fixed dollar amount the insured person pays for their visit or procedure. They are a standard part of many health insurance plans and are usually collected for services like doctor visits or prescription drugs. For example: You go to the doctor because you are feeling sick. Your insurance policy states that you have a $20 copay for doctor office visits. You pay your $20 copay at the time of service and see the doctor. Coinsurance This is typically a percentage of the total cost of a visit or procedure. Like copays, coinsurance is a standard form of cost-sharing found in many insurance plans. For example: After a fall, you require crutches while you heal. Your coinsurance for durable medical equipment, like crutches, is 20% of the total cost. The crutches cost $50, so your insurance company will pay $40, or 80%, of the total cost. You will be billed $10 for your 20% coinsurance.