Buscar

-

3 Reasons to Choose a Senior Care Plus Health Plan

Senior Care Plus was Nevada’s first Medicare Advantage Plan and is still providing healthcare coverage to qualifying members in Washoe, Carson City, Clark & Nye Counties. Senior Care Plus is administered by Hometown Health, the insurance division of Renown Health. That relationship means Senior Care Plus is the only Medicare Advantage Plan supported and accepted at Renown. This preferred access to Renown is a great benefit for northern Nevadans. When it comes to healthcare coverage, there are three key factors to keep in mind. Here’s why a Senior Care Plus Medicare Advantage Plan is your best choice. 1. Cost Cost matters when searching for the right insurance plan. Of the four Senior Care Plus plans available to residents of Washoe County and Carson City, three offer a zero-dollar monthly premium and all of them offer zero-dollar primary care office visits. That means no out-of-pocket costs for you. Additionally, all Senior Care Plus plans have an annual out-of-pocket maximum. This means when you reach this amount, that’s all you will pay. Senior Care Plus pays all other covered medical benefits for the rest of the year. That’s the beauty of a Senior Care Plus Medicare Advantage Plan. 2. Size of Provider Network and Accessibility Although saving money is important, it’s more important to be able to see a doctor when and where you need to. Senior Care Plus members enjoy the most comprehensive healthcare provider network in the region. Thousands of providers, including many hard-to-find specialists, are in the Senior Care Plus network. Since Senior Care Plus is part of the Renown Health family, you get priority access to all that Renown has to offer, which you won’t find with any other Medicare Advantage Plan. 3. Coverage Medical coverage needs are personal and unique to every member. Understanding a plan’s benefits is essential when picking the best coverage for you. Of course, the important benefits you associate with a healthcare plan are included in all Senior Care Plus plans: urgent care visits, specialists’ visits, lab services, imaging — all with reasonable copays. What sets Senior Care Plus apart from the rest are the additional benefits for preventive health. For example, Senior Care Plus offers plans with a comprehensive dental benefit with first-dollar coverage, meaning you pay nothing until the benefit limit is reached. Senior Care Plus Medicare Advantage Plans also have a vision benefit allowing you to get a new pair of eyeglasses every year. In addition, these plans offer a fitness benefit, so you can join a local gym because Senior Care Plus wants to keep you healthy. Another interesting benefit is the over-the-counter benefit. If you choose the Renown Preferred Plan, you can select $50 worth of over-the-counter products such as: cold medicine, dental products, diabetic supplies, and digestive aides. Remember, that’s $50 worth of over-the-counter products four times per year. All on a plan that doesn’t cost a thing. Senior Care Plus Medicare Advantage Plans offer many added benefits tailored to Nevadans.

Read More About 3 Reasons to Choose a Senior Care Plus Health Plan

-

3,000 Miles Away But Close to Home

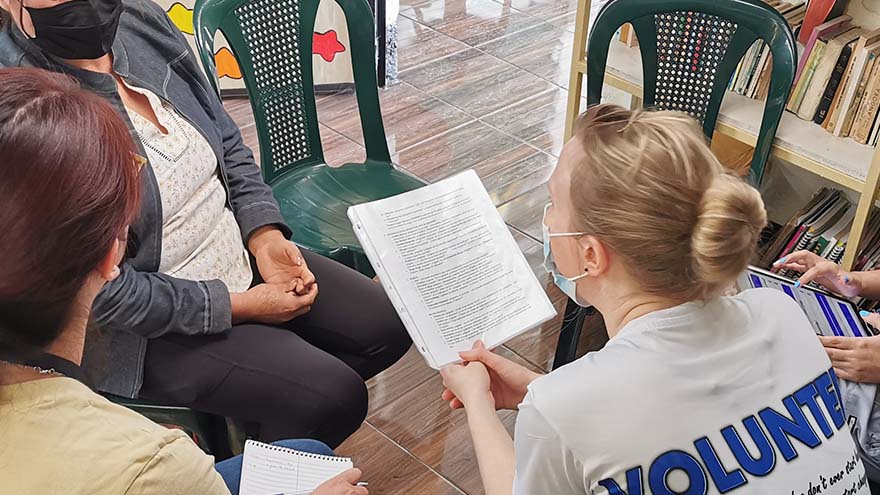

Overcoming poverty is not a task of charity, it is an act of justice. Like slavery and apartheid, poverty is not natural. It is man-made and can overcome by the actions of human beings. Sometimes it falls on a generation to be great. You can be that great generation. Let your greatness bloom. – Nelson Mandela, February 2005, Make Poverty History Campaign in London Lifting away the curtain that symbolized the front door, I entered a dark, cinderblock room and instantly became overwhelmed by an unpleasant odor. Working with oncology patients as a Child Life Specialist and an Occupational Therapist for over ten years, I recognized that smell. I had arrived in Guatemala – more than 3,000 miles from Reno – and it was my first day of a week-long trip where I would be serving alongside physicians in low-income communities providing free medical care for residents. My name is Brittany Jemmoua, I am an occupational therapist at Renown, and I recently volunteered with Kalan Kuxtal, a non-profit Guatemalan organization. I served alongside physicians by providing free primary care mobile clinics and home visits. The care we provided focused on prevention, intervention, education and lifestyle/medication management as we partnered with local entities, such as fire stations, community centers and schools to transform hundreds of lives. Speaking in both English and Spanish, I collected patient intake information, performed exams, tested for diabetes, and collaborated on a diabetes research project focused on daily risk assessment. Beyond these tasks, I immersed myself in the culture and learned more from the Guatemalan people than I could have ever imagined. Similar to Renown, Kalan Kuxtal Operates with Community at its Core Kalan Kuxtal, a Mayan expression meaning “life guardian,” is different from other volunteer medical trip organizations, and I took home valuable insights and lessons from their way of life that I now consider daily in my practice at Renown. I expanded my knowledge about diabetes, hypertension, pharmacology, infectious diseases, pregnancy complication, vector-borne illness and tuberculosis. We conducted home visits for socially neglected populations rather than expecting everyone to come to our clinics. I found that being welcomed into people’s homes gives you a different lens in which to view how their medical diagnoses interact with living conditions, occupations, and quality of life. This is when I met Mercedes and her mom. Her mom, Ms. Valencia, had jaundice skin and a substantial Basal Cell Carcinoma aggressively protruding from her face that impacted eating, hearing, seeing, sleep and social interactions. This opportunity to serve within their home led to an important palliative care conversation that would have been missed had we stayed in the clinic. We combed the rural neighborhoods assessing people’s risk for diabetes, taking glucose tests and educating families about their next steps. Many individuals had uncontrolled diabetes and misunderstandings regarding basic health management strategies. At the end of the day, many people demonstrated feelings of empowerment by actively offering solutions regarding how they will manage their day-to-day glucose with diet and exercise. Small actions can lead to big changes, and in the long-term, these health actions can help them avoid medication costs and focus on affording basic life necessities, such as water and electricity. Kalan Kuxtal organized a cultural day that included going to local businesses and community leaders to learn more about how they support the people of Guatemala. For example, Valhalla Macadamia Farm’s main goal is to help communities gain access to income, employment, and improved wellbeing by donating macadamia trees to families to grow and then sell macadamia products. A Weeklong Trip with Lifelong Impacts Each patient made a lasting impact on me, both personally and professionally. One specific family I saw in the clinic had a unique situation in that their two-year-old daughter, Margareth Elizabeth Cifuentes Bautista, was laboriously diagnosed with irregular corneal syndrome associated with glaucoma of congenital origin. Due to Guatemala’s limited prenatal screens and interventions, Elizabeth is nearly blind. While highly spirited and happy, she trips, bumps and feels her way through life. One barrier to her healthcare access is that her hard-working parents remain well below the poverty line, making less than $900/month. I am working to connect them with generous US Ophthalmologists and pediatric eye specialists to explore how we might save her sight and help her family. Their biggest dream is that she could recover her eyesight. “I know that this is not a life-threatening situation, but it is still something that never stops hurting me,” Jorge Cifuentes, Elizabeth’s father, said. “Unfortunately, our situation here is very hard. This country [Guatemala], although beautiful, it is very difficult to get ahead. We are people living in underprivileged conditions which complicates our situation even more. However, we are still trying to thrive by being kind and hardworking people. Thank you for helping us.” I have had the privilege of an opportunity for education, access to healthcare, employment and am aware that inequity and injustice prevail. This experience reinforced my understanding that medicine is a physically and mentally demanding profession that requires a commitment to service, continuous learning and adaptation both on local and global scales. I encourage everyone to please join me in serving the underserved by volunteering. Brittany is an experienced Occupational Therapist at Renown and volunteers with Kalan Kuxtal and other entities, such as The Robert Unsworth Foundation and Rock Steady Boxing to elevate communities. She loves being an Occupational Therapist; however, her life experiences confirm that her true calling is to become a physician. She is currently applying to medical school. Brittany is eager to earn the responsibility to improve lives and communities as their engaged physician. Brittany is tentatively scheduled to return to Guatemala at the end of this year to continue partnering with the people for a better future. You are welcome to join!

-

5 Benefits of Medicare Advantage Plans

If you are approaching age 65, you may be starting to think about the government benefits you will soon qualify for. For example, your healthcare option to elect between Original Medicare or a Medicare Advantage plan. What’s the difference? Original Medicare comes in two parts: Part A and Part B. Part A covers a portion of hospitalization expenses, and Part B applies to doctor visits and medical expenses, such as lab tests and some preventative screenings. A Medicare Advantage plan, also known as Part C, is an “all-in-one” alternative to Original Medicare. These “bundled” plans include the benefits of Part A, Part B and Part D (prescription drugs). Some people choose a Medicare Advantage Plans over Original Medicare because these plans offer coverage like vision, hearing, dental and more. Saves You Money First and foremost, Medicare Advantage Plans save Medicare members money –and not just a little bit of money, but a lot of money. Original Medicare only pays 80% of the cost of medical care – the Medicare beneficiary is responsible for the other 20%. A Medicare Advantage Plan is different. The Medicare Beneficiary is only responsible for a small copay, typically less than 20% of a doctor visit or procedure. More importantly, Medicare Advantage Plans have a maximum out-of-pocket amount, meaning that once you reach the limit, the Plan pays 100% of all medical services. That alone can save thousands of dollars per year – particularly if there is a hospitalization involved. Dental, Vision and Hearing Coverage What sets Medicare Advantage plans apart is the additional benefits provided that Original Medicare doesn’t cover. These benefits include dental coverage, vision coverage, hearing exams and hearing aid coverage. None of these important health care benefits are included in Original Medicare. Also, most Medicare Advantage Plans include prescription drug coverage at no additional cost, while individuals with Original Medicare need to sign-up and pay extra for Part D prescription drug coverage. Medicare Advantage Plans offer more benefits than Original Medicare and they help members save on their health care costs. Focus on Accessibility, Wellness and Preventative Health Accessible healthcare coverage is key to staying on top of your health. To join a Medicare Advantage Plan you must have Part A and Part B coverage and live in the plan’s service area. It is important to remember that Original Medicare is only valid in the United States. Fortunately, many Medicare Advantage Plans offer worldwide emergency coverage. Another important healthcare consideration to keep in mind is Medicare Advantage Plans focus on your overall well-being. They offer preventative and wellness-related benefits at no cost to you. This includes important benefits like free over-the-counter medicines and free gym memberships. You won’t find those types of benefits with Original Medicare. Medicare Supplement Plans (Medigap) Some people confuse a Medicare Supplement Plan, also known as a Medigap Plan, with Medicare Advantage Plans. They are different and the biggest difference is Medicare Supplement plans come with ever-increasing premiums because they are based on your age. This means the cost of these plans increase every year. Plus, they don’t offer any supplemental benefit coverage like vision, dental or hearing. That’s not the case with a Medicare Advantage Plan. In many cases, there is no monthly premium and you receive all manner of supplemental benefits. These benefit-rich, zero-dollar premium Medicare Advantage plans are enticing people to say goodbye to pricy Medicare supplement plans and hello to Medicare Advantage Plans. Don’t worry, if you join a Medicare Advantage Plan for the first time and you aren’t happy with the plan, you’ll have special rights under federal law to buy a Medigap policy and a Medicare drug plan if you return to Original Medicare within 12 months of joining the Medicare Advantage Plan. The Flexibility to Change Your Mind A common misconception about Medicare Advantage Plans is that when you join, you are still on Medicare and are not giving up your Medicare coverage. Medicare Advantage Plans are considered “Medicare Part C.” This means they combine your Medicare Part A (hospital coverage), Part B (doctor’s coverage) and Part D (prescription drug coverage) into one convenient package that costs less and provides more. You can only join, switch or drop a Medicare Advantage Plan during the enrollment periods: Initial Enrollment Period: When you first become eligible for Medicare, you can sign up during your Initial Enrollment Period. For many, this is the seven-month period that begins three months before the month you turn 65, includes the month you turn 65, and ends three months after the month you turn 65. General Enrollment Period: If you have Part A coverage and you get Part B for the first time during this period (between January 1 - March 31 each year), you can also join a Medicare Advantage Plan. Your coverage may not start until July 1. Annual Election Period: Between October 15 and December 7, anyone with Medicare can join, switch or drop a Medicare Advantage Plan. Your coverage will begin on January 1 (as long as the plan receives your request by December 7). Medicare Advantage Plans have been around for more than 25 years and continue to grow in popularity. In some parts of the country, more than half of all Medicare beneficiaries are enrolled in a Medicare Advantage Plan. Only 40% are enrolled here in Nevada, but that number is growing every year.