Buscar

-

Cómo comenzar y actualizar su testamento

August is National Make-a-Will Month. We talked to Abbey Stephenson, Planned Giving Officer at Renown Health Foundation, to learn more about wills, trusts and estate plans and why you should feel motivated this month to get started. Why Make a Will There are so many reasons why it is difficult to make a will or put an estate plan in place. These include: Lack of time or money to prepare a plan The misperception that “only rich people need an ‘estate plan’” How intimidating legal documents can be General discomfort with planning for the future Given the barriers to making a plan, it’s not surprising that only 32% of Americans have a will or trust in place. But having a will or trust matters because these are the documents where you can say who will inherit your assets, who will manage your assets and estate, and who should be guardian of a minor or a child with a disability. Where to Begin If you have been thinking about putting together a will and don’t know where to begin, here are some next steps you can take. 1. Learn the terms. If you have never created a will, trust, or an estate plan, the language can be hard to get used to. A few important terms to know include: Last will and testament (also known as a will): a legal document that describes how you would like your property and other assets to be distributed after your death. This is also the document where you can nominate a guardian for a minor or disabled child. Personal representative (also known as an executor): a person named in a will responsible for collecting your assets, paying your debts and final taxes, and distributing the remaining assets to those stated in your will. Personal representatives must be formally appointed by a judge and report certain information to the judge for review and approval. Living trust (also known as a revocable or family trust): a legal arrangement set up through a document called a trust instrument or a declaration of trust that gives someone called the trustee power to make decisions about the trust creator’s money or property held in the trust. Estate plan: a collection of documents that help organize what happens to you and your assets upon your disability and death. Your estate plan is comprised of documents such as a will, trust, and advance health care directive. If you want to learn more about these terms and estate planning in general, you are invited to attend a free one-hour estate planning education session on Aug. 22, 2024, at 10 a.m. or Oct. 21, 2024, at 11 a.m., hosted by Renown Health Foundation. Click here for more information and to register. 2. Create a list of assets. Start by creating a list of your assets including real estate, investments, bank accounts, retirement accounts, business ownership interests, vehicles, life insurance, valuable personal property like jewelry or artwork, and any other significant assets. Click here and read our free estate planning guide. 3. Put together a list of 2-3 people you trust. When you create your will, you need to name a personal representative who will collect all your assets, pay your debts, and work with the probate court to distribute the balance to the people and charities you name in your will. If you create a trust, you need to name a trustee to manage the trust assets under the terms of the trust document. It is a good idea to include at least two people who can take on these roles in case the first person becomes unavailable. If you do not have anyone you would trust as a personal representative or trustee, there are trust companies, banks, and other professionals and institutions who may be able to assist you. If you are the parent of a child who is under 18 or has a disability, you will also nominate a guardian in your will to care for that child if you and the other parent are gone. 4. Start a list of who you would like to inherit your assets. Which people and organizations would you like to inherit the assets you own at the time of your passing? And which assets or how much would you like them to receive? You might want to consider who relies on you for support such as family members or charities, individuals and organizations that have made a difference in your life, or those you have a special fondness for. It is important to use the legal names of individuals you include as beneficiaries and the Tax ID number for any charity you include. If you decide to make a gift to Renown as part of your will or estate plan and notify us, you will be included in the Renown Legacy Society. Legacy Society members enjoy invitations to exclusive events, special acknowledgments, and other unique benefits. Click here to learn more about the Renown Legacy Society. 5. Put together a list of your professional advisors and enlist their help. Write down the names and contact details for any professional advisors you work with such as your accountant, financial advisor, investment manager, attorney, insurance agent, and planned giving officer. You may want to seek their advice on how best to proceed and which assets are best gifted to which individuals and organizations from a tax standpoint. Collaboration among the professionals with whom you work can help your plan to run more smoothly when it is needed. Depending on your circumstances, it may make sense for you to introduce your trusted individuals to these professionals. 6. Start drafting. Once you have these items in place, you will be in a good position to begin the drafting process. There are many capable estate planning attorneys in our community who can help you with drafting. There are other drafting resources available as well, but only a licensed attorney can provide you with legal advice. Click here to attend the free Family Estate Planning Series sponsored by Renown and presented by PBS Reno and the Community Foundation of Northern Nevada.

Read More About How to Get Started and Make Updates to Your Will

-

Asociación de Renown Health con la campaña Nevada Fitness

In 2021, Renown Health partnered with the National Fitness Campaign (NFC) to construct outdoor “Fitness Courts” in public spaces across the state. The partnership was formed to fight obesity, improve quality of life and create equitable access to outdoor exercise programs for communities around the state – bringing community wellness programs and free digital workouts to thousands of people. The Renown Health and NFC Campaign in Nevada is delivering outdoor wellness infrastructure to help communities stay active across the state and to change health outcomes. Out of Nevada's 16 counties, Fitness Courts® are now open in three. A Complete Bodyweight Workout at Seven Exercise Stations The Fitness Court is the world’s best outdoor gym that lets people use their own body weight to get a complete workout using seven exercise stations. Created for people ages 14 and over and with all abilities in mind, the workouts are adaptable for all fitness levels, allowing participants to move at their own pace. Users may also download the free Fitness Court App, which acts as a coach-in-your-pocket and enhances the outdoor gym into a digitally supported wellness experience. "Proximity to exercise opportunities, such as parks and recreation facilities, has been linked to an increase in physical activity among residents,” said Dr. Brian Erling, President & CEO of Renown Health. “Regular physical activity has a wide array of health benefits including weight control, muscle and bone strengthening, improved mental health and mood, and improved life expectancy. We are proud to bring additional access to exercise opportunities – at no charge, to everyone in our community.” Renown-Sponsored Fitness Courts Across Northern Nevada Rancho San Rafael 1595 N Sierra Street, Reno, NV 89503 South Valleys Regional Park 15650 Wedge Parkway, Reno, NV 89511 Ardmore Park 1200 12th Street, Sparks, NV 89431 Angel Park W Sage Street, Elko, NV 89801 Elquist Park 561 Altenburg Ave., Battle Mountain, NV 89820 To learn more visit Nevada Fitness Courts.

Read More About Renown Health Partnership with the Nevada Fitness Campaign

-

Los beneficios de salud inigualables de las raquetas de nieve

Snowshoeing is an excellent winter workout that can help burn calories, strengthen muscles and boost cardiovascular health. Explore the top 8 snowshoeing spots and experience this ultimate workout adventure! Significant Health Benefits: Exceptional cardiovascular workout – burn up to 1,000 calories per hour! Low-impact muscle building Endurance building Balance strengthening and agility Improves your sense of well-being by connecting to nature Prepping for Your Adventure There are some crucial details to think about when it comes to snowshoeing, especially if you are a beginner. Make sure to pick the right kind of footwear to go on top of your snowshoes; a pair of comfortable waterproof boots are a great choice and remember to wear lots of layers. Several local places rent snowshoes if you aren’t sure about spending money on a pair. Check out Bobos Ski and Board Patio or our local REI Co-Op. Check out REI’s Beginner’s Guide to Snowshoeing for reference. 8 Cool Snowshoeing Spots 1. Galena Creek Park Close to Reno, this beautiful, low-altitude park offers several trails. You’ll find various creeks and streams under cover of pristine ponderosa pines. From beginner to advanced, the differing trail systems provide a challenge for everyone! Head west on State Route 431 (Mt. Rose Highway) for about seven miles until you see the park sign on the right side of the highway. 2. Tahoe Meadows – Chickadee Ridge This local favorite not only gives fantastic views of Lake Tahoe but the best part? – friendly little chickadees will eat seeds right out of your hand! Be sure to pack plenty of sunflower birdseed, as that seems to be their favorite. From the trailhead parking lot, head southeast into the open meadow. Then follow the ridgeline to your right (southwest). Continue southwest up toward the top of the ridgeline to the west, and you’ll get to Chickadee Ridge in just under two miles. 3. Spooner Lake Trail The easy 2.5-mile loop around Spooner Lake is excellent for all skill levels. This alpine lake is surrounded by aspen trees which house varied bird species, so bring your binoculars! Dogs are allowed on a leash, and all-day parking is $10. 4. Kirkwood Ski Resort You’ll need a trail pass, but this South Lake Tahoe resort has various routes from beginner to advanced, with roughly 50 miles of terrain. Nighttime snowshoe treks during the full moon are also available throughout the winter. Kirkwood is located on Highway 88, close to Carson Pass. 5. Camp Richardson Heading north, you can find this well-established and favorite local snowshoeing spot. If you’re up for an adventure, you can trek up to Fallen Leaf Lake. It’s located off Highway 89 and near Fallen Leaf Road. 6. Dry Pond Loop This moderate, 6.5-mile loop near Washoe Valley has impressive views of Carson Valley, Washoe Lake, and the Mt. Rose Wilderness. If you like the sound of rushing water, most of the trail meanders along White’s Creek. This area is dog-friendly and kid-friendly, which makes it a family favorite. 7. Royal Gorge Soda Springs is home to this resort, which is well known for its cross-country skiing trails. Enjoy extensive trails leading deep into the trees with spectacular views. Find Royal Gorge from the Soda Springs exit on West Interstate 80. 8. Ash Canyon Creek Tucked away in the Carson Valley, these trails are filled with mountain bikes in the spring and provide excellent snowshoeing trails in the winter. Find it from Interstate 580 by taking the Highway 395 Business exit to Winnie Lane.

Read More About The Unmatched Health Benefits of Snowshoeing

-

Patty Warren Una mujer de fuerza y resiliencia

Meet and get to know Patty Warren, our featured Sterling Silver Club member this fall. You may recognize her from the latest Senior Care Plus commercial on television, where she joins a coffee chat discussing the many benefits of being a Senior Care Plus member. She’s one of the kindest souls you’ll ever meet – and has a positive outlook on life that we should all strive for. Patty's Story Patty was born and raised in a small Kansas town called Baxter Springs, where she grew up with an older brother, an older sister and two younger sisters. She and her siblings all enjoyed playing sports like softball and basketball, in addition to playing instruments. Patty developed a love and passion for music at a young age that carried into her adulthood. “I wanted to be an opera singer,” said Patty. “I decided to go to college at Pittsburg State University in Kansas where I majored in vocal performance.” After college, Patty moved to Manhattan in New York City to audition to be an opera singer, but she soon realized it wasn’t what she wanted to do after all. She eventually decided to work in the brokerage industry. After living and working in New York for three years, Patty moved back to Kansas where she later met the love of her life, Michael. “In 1992, I had put a dating ad in the local newspaper,” said Patty. “I received over 30 responses, and I went out on quite a few dates.” Then she had her first date with Michael, and the two of them quickly realized how much they liked each other. He asked her to marry him on Valentine’s Day in 1993, and they went on to get married in front of the Justice of the Peace on May 3, just a few months later. “We had a small wedding so that we could move into our first home together,” said Patty. A few years later in 1999, Patty and Michael moved to Arizona, where they lived for 22 years. Patty worked at Edward Jones Investments for 18 of those 22 years and loved her job and the people that she worked with. She retired in January 2021 during the pandemic, and three days later she and Michael moved to Sparks, Nevada.

Read More About Patty Warren A Woman of Strength and Resilience

-

¿Por qué me cae el cabello? Explicación de la alopecia

© MikeSaran via Canva.com Hair is often considered a symbol of identity and self-expression, from scalps and eyebrows to beards and bodies. But what happens when this symbol starts to fall out? The 6.7 million people across the country living with alopecia know this feeling all too well. Alopecia, or hair loss, is a medical condition with variable causes, presentations and treatments. Experts at Renown Health dive into the world of alopecia, its causes and how to address it – especially as we embrace National Alopecia Awareness Month this September. Types of Alopecia The term “alopecia” is a broad umbrella term that encompasses many different forms of hair loss that can present itself at any age, no matter your gender or ethnicity. The most common types include: Alopecia Areata: An autoimmune disorder where the immune system targets hair follicles, typically resulting in patches of hair loss on the scalp and/or other body parts. More severe forms of alopecia areata also exist, such as alopecia totalis and alopecia universalis. Androgenetic (or Androgenic) Alopecia: A disorder also known as male or female pattern baldness that causes gradual hair thinning and loss often around the temples and crown. Unlike alopecia areata, this form of alopecia is usually hereditary. Telogen Effluvium: A condition resulting in hair shedding, typically after high-stress or infectious events, such as after giving birth or after a COVID-19 infection. This usually resolves itself within a few months to a year. Traction Alopecia: Hair loss resulting from the effects of tight braiding or styling of the hair, which can cause permanent loss over time. Scarring and Inflammation-Mediated Hair Loss: Patterns of hair loss related to lupus, lichen planus or other autoimmune conditions that can unfortunately be permanent and progressive. Options to Treat Alopecia While there isn’t a cure for most types of alopecia, some treatments are available to help minimize the effects of the condition and promote hair growth. Treatment varies depending on the type of alopecia. Potential options can include: Topical Minoxidil: An FDA-approved over-the-counter medication available in foam or liquid form and applied directly to the scalp, which helps stimulate hair growth by increasing blood flow to hair follicles. Hormone Therapies: A hormone regimen that can help minimize the resulting hair thinning and balding. Corticosteroids: A topical cream or ointment – or an injection for severe cases – that help reduce inflammation and re-grow hair. Low-Level Laser Therapy: A therapeutic, non-invasive intervention involving wearing special caps or combs that release painless, low-level lasers to stimulate hair follicles. Healthy Diets and Nutritional Supplements: A diet rich in vitamins and minerals essential for hair health, such as biotin and collagen, can aid in recovery. Vitamin D and iron are also important hair growth nutrients. Stress Management: Stress can impact the speed and frequency of hair loss. Managing your stress can help mitigate the effects of alopecia. Treatment for alopecia is not a one-size-fits-all approach. A scalp skin biopsy may help determine a cause for hair loss and help guide the best management strategies with your provider. Addressing the Emotional Impacts Even though alopecia isn’t life-threatening, the impacts of the condition can affect your self-esteem and self-image. The most powerful tool to help you manage alopecia is knowledge. Keeping yourself educated about your condition, and encouraging your loved ones to do the same, can help arm yourself with the acceptance and self-compassion you need and help combat misconceptions. With the rise in awareness in the mainstream media for alopecia and other hair conditions, beauty standards and fashion are shifting to become more inclusive for those experiencing hair loss. Celebrating the many diverse hairstyles and fashion statements can help you regain your confidence. There are many options you can advantage of to help style your hair and protect your scalp: Hairpieces: Wigs, extensions and other hairpieces can help cover up balding or thinning patches and add volume to your hair. Hairpieces have come a long way in the past few decades, and many use real human hair. Hats: Hats serve a dual purpose – a fun fashion accessory to help boost your confidence and a method of protecting your scalp from the sun. As someone with alopecia, your scalp is more exposed, and hats can provide that extra layer of protection you need. Scalp Sunscreens: While regular body sunscreens can provide good scalp sun protection, they can result in oily scalp and hair appearance. Sunscreens that are specifically designed for the scalp are available at most beauty stores or online. Remember, patience is fundamental, as many treatments require consistent use over time to see noticeable results. Stay resilient, and don’t give up – you are not alone in your alopecia journey.

Read More About Why Is My Hair Falling Out? Alopecia Explained

-

11 Consejos que los cuidadores deben conocer

Becoming a caregiver or playing a more active role in another’s healthcare is a big responsibility. At some point, almost all adults will support an aging parent or a loved one in need. Keeping track of their needs and wellbeing, while also prioritizing your own can become overwhelming. It’s important to know: you are not alone, and help is available. Read on for 11 tips to help you manage your time, your own wellbeing and your loved one’s care. Self-care comes first. When your main priority is the person in your life who needs care, it’s easy for your own needs to take the backseat. Give yourself time each day to focus on your personal wellbeing. It’s hard to give a loved one the care they need if your own needs are not met. Prioritize the Activities of Daily Living (ADL). Make a note of what ADLs your loved one can do alone, what they need help with and what activities require the most help. This will help you work through the day with them, as well as plan out how the day’s activities will go. Do a home safety audit. Do showers, bathtubs and steps have safety grab bars? Look around the house for additional tripping hazards, like rugs or electrical cords. If your loved one struggles with day-to-day navigation of the home, consider scheduling an occupational therapy appointment. This type of therapy helps a person develop or maintain the motions required to accomplish daily tasks. You might also qualify for a referral to in-home healthcare, such as Home Care. Have the hard conversation. The best time to discuss views about end of life care and to learn what choices are available is before a life-limiting illness or crisis occurs. With advance care planning, you can help reduce the doubt and anxiety related to decision making at the end of life. Completing an Advance Directive is a great tool to sort out all these decisions before they’re needed. Attend a free workshop to learn more and complete this important document. Identify when you need respite. Respite care involves receiving a short-term break from caregiving. Organizing in-home care for your loved one will allow you to step away and tend to your needs. By identifying what kind of respite care you are seeking, you can find the right person to provide you with that much-needed break. Don’t wait until you feel overwhelmed, plan ahead. Write down insurance contact information. Have a direct connection to the right insurance professional for support and advice. If your loved one is eligible Medicare, this is a good opportunity to review their current selections and if they would benefit from a Medicare Advantage Plan or Medicare Supplement Insurance. Seeking out expert advice or information on Medicare options is a great way to navigate this. Consider calling a broker, or attend a free educational seminar with Senior Care Plus. Gather legal and financial information. Make a list of all existing legal documents and financial accounts that your loved one has. These might include a will, advance directive, power of attorney, bank accounts or investment accounts. If you have questions about how to manage them, or need assistance in setting up additional framework, reach out to a lawyer, legal service, financial adviser or bank representative. Create an inventory of medical information. Identify where all of your loved one’s medical records are, as well as a list of providers or healthcare practices where they have received care. Consider if you should have your loved one give you Proxy Access in MyChart, which allows you to access all the features in MyChart on their behalf, including viewing upcoming appointments, viewing test results and emailing a doctor on their behalf. Make a list of what others can do. Think about all the little (and big) things that need to happen, and write down tasks that others could take care of you. When someone says “let me know what I can do” you’ll be ready with a pre-written list of items they may be able to assist with. Tasks could include tackling around-the-house repairs, scheduling lawn work, helping to walk the dog, taking a car for an oil change and cleaning. Find programs and events for social enjoyment. If and when possible, seek an activity outside of the home. Look for community centers that have programs for seniors, recreational activities or meals that you can patriciate in together. If leaving the home is not an option, arrange for visits or in-home activities, such as movie nights, card games or time to visit with family. Research long-term options. If you will be considering a nursing home or assisted living, make a list of amenities that you and the person you are caring for would like. Take this list with you when visiting potential locations to make sure you don’t forget to ask about each item.

-

A Senior Care Plus le encanta Pickleball

Senior Care Plus is pleased to announce we are now a proud sponsor of Jam On It Pickleball, open to the community seven days a week at the Reno Sparks Convention Center. We’re excited to help promote this fun activity to our members, employees and the public. Pickleball has many wonderful health benefits – particularly for seniors. It’s a low-impact game that raises the heart rate, improves hand-eye coordination and increases mobility. In addition to the obvious physical benefits, pickleball is a great social activity. Getting out of the house and playing a fun, easy-to-learn game with others is a great way to make new friends while improving your physical and mental health! Ralph Barbato, a Senior Care Plus member from Reno, is a huge fan of pickleball and all it has to offer. “Pickleball has made such a positive impact on my life. I love the physical and mental health benefits along with the social aspect – it’s a great way to meet new people and I’m excited to have it in our community,” said Ralph.

-

Tami brillante de plata de ley

Shining Brightly We all carry a light inside of us. Some people seem to have a constant glow while others flicker brightly here or there depending on what they’re doing or who they’re with. But for another select group, the light they embody is closer to a sunrise, illuminating and embracing everything and everyone it touches. Do you think that’s a bit heavy-handed or just a writer’s poetic exaggeration? Well, that’s because you haven’t met this issue’s featured Sterling Silver Club member, Tami, yet. But that’s about to change… This Little Light of Mine As an infant, Tami’s adoptive parents were drawn to her light, even though the couple had come to an orphanage in Washington state hoping to find an older child to add to their family. “My parents always said that after seeing and holding me, they had to take me home,” Tami remembers and then smiles. “They also liked to tell the story of how they sold their prize baby bull, Johnny Apollo, to pay my adoption fees!” Tami has fond memories of making mud pies and climbing trees as a child and feels privileged to have been raised by older parents. “They both lived through the Great Depression and my dad proudly served in the U.S. Navy in World War ll,” says Tami. “I certainly attribute learning to love and give unconditionally through their humble ways. I had the honor of taking care of them both for about 10 years before their passing. When asked who my heroes are, though I have several, they are at the top of that list for sure.” Today, Tami is married to her high school sweetheart, Richard. They’ve been together for 43 years and have five children – and 10 grandchildren – of their own. Helping Others Through Darkness Tami started a highway construction business with her family in 2000, but focused 18 years of her career around her love of teaching, with seven years spent as Vice Principal of Academics at Reno Christian Academy. One of her greatest joys during that time was implementing Prime Time, a program that set aside special time for students who had experienced recent traumatic events. “I used puppets, sewing, crafts – any activity the students would respond to,” explains Tami. “But mostly, I listened.” And when one of her students shared, “I just want someone to listen to me for an hour today” – that’s what she did. “We sat on the sidewalk and ate Fudgsicles and giggled at the silliest things,” Tami recalls with some emotion. “And when we both left smiling, I was reminded that the most beautiful moments are when we are simply present with an open heart.”

-

Planifique con anticipación: Cómo completar su directiva anticipada

We plan for the birth of a child, weddings and retirement, but rarely do we discuss how we want to be cared for at the end of our lives. Getting through this challenging conversation and completing an Advance Directive can give you peace of mind that your loved ones will not have to make difficult choices on your behalf. The best time to complete an Advance Directive is now – don’t wait until a life-limiting illness or crisis occurs to discuss your views about end-of-life care and to learn what choices are available. By preparing in advance, you can help reduce the doubt and anxiety related to decision-making for your family if you cannot speak for yourself. What are Advance Directives? An Advance Directive is a document that states your choices about medical treatment and names another person to make medical decisions on your behalf if you are unable to. This document allows you to make legally valid decisions about future medical care. “Completing your Advance Directive is a gift you give your family,” says Director of Palliative Care, Mary-Ann Brown RN, MSN. “The stress associated with these difficult decisions is decreased if everyone knows what is important to you and what you want at the end of life.”

Read More About Plan Early: Completing Your Advance Directive

-

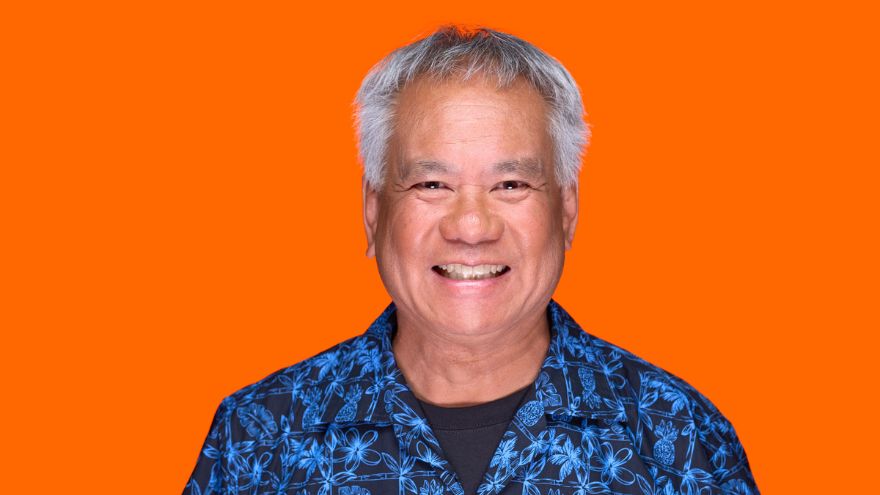

Conozca al miembro multifacético Don Chang

Renaissance Don The Sterling Silver Club is honored to have thousands of members who’ve led and continue to lead incredibly vibrant and diverse lives. And we’re absolutely thrilled when those members volunteer to share their stories and experiences so we can all appreciate and learn from them. This issue’s featured member is no exception. From his love of cooking, travel and music to his drive to learn new languages, take on new hobbies and keep himself active and fit, Don is an aspiring Renaissance man who may already be deserving of the title. Revolutionary Family Roots Don’s father, who was born in Beijing, China, earned a master’s degree in metallurgical engineering from the University of California, Berkeley and was working on his PhD there on a full scholarship from his home country when the Chinese Communist Revolution occurred. In order to stay in the United States and avoid potentially being thrown into prison by the new communist regime (a fate that befell some of his family members), his father married Don’s mother, who was a U.S. citizen and also a student at Berkeley. Together, they started a family. “My father met my mother in a class and received his green card by marrying her,” says Don. “They proceeded to have six kids in nine years, I was number three. Dad never finished his PhD, but clearly earned what we like to call his “PSK” degree – Papa with Six Kids.” Proud (of) Papa: Don’s father was a professor of metallurgy and a brilliant research scientist who was responsible for virtually every breakthrough in the development of titanium in the 1960s.

-

Errores de planificación patrimonial que se deben evitar

August is National Make-a-Will month. We talked to Renown Health Foundation Planned Giving Officer, Abbey Stephenson, to learn more about wills, trusts, and estate plans and why you should feel motivated this month to get started. Did you know that 2/3 of Americans don't have a will or trust? If this is you, don’t worry, you’re not alone. Although there are laws in place to determine who inherits your assets if you die without a will or trust, having a will or trust ensures your assets go where you want them to go after you are gone. They can also help minimize disputes between family members and heirs about who gets what. In Nevada, the laws that govern who gets what if you die without a will or trust can be found in Chapter 134 of the Nevada Revised Statutes. There are other documents that people often prepare at the same time as their will or trust – like an advance health care directive and durable power of attorney for assets. These documents all together are called an estate plan. Although they have other purposes too (like nominating a guardian for a child, planning for disability or avoiding probate, which is a court process), wills and trusts are documents that say who will receive your assets after you are gone. The most common type of trust is often called a revocable living trust or a family trust. People who have a trust usually still have a will, although it is a shorter form of will called a pour-over will. It’s a good idea to talk to an estate planning attorney about whether or not a trust makes sense for your family or circumstances. Now that you’re ready to get started, here are some mistakes to avoid: 1. Failing to plan Not setting aside the time to plan may be the biggest mistake. Failing to prioritize preparing or updating your estate plan means your last wishes and desires may not be fulfilled. The right documents memorialize what you would like to happen upon your disability and death so that other people can know and follow your wishes with respect to your care and your assets. 2. Failing to coordinate beneficiary designations Certain types of assets like life insurance and retirement accounts are not covered by your will or trust and need to be addressed separately. These types of assets are referred to as non-probate assets because they transfer under contract principles and don’t require court supervision or probate to be distributed to the named beneficiaries. By completing beneficiary designation forms provided by the retirement account custodian, insurance company or financial institution, you can direct your assets to one or more beneficiaries. 3. Failing to title your assets properly Asset titling refers to how you own your asset – such as in your individual name, jointly with someone else, or in a trust or entity. For example, assets titled for two people with a “right of survivorship” will automatically go to the surviving owner. Review your asset titling and make changes, if needed, to ensure your property and assets are passed down the way you intend. 4. Failing to include charities meaningful to you In addition to providing for family members and other important people in your life, you many also choose to give to charities meaningful to you in your estate plan. When you include a charity in your estate plan, that gift is called a planned gift and many charitable organizations, including Renown, recognize such donations through their legacy giving societies. As you prepare to make your own will or a more comprehensive estate plan, we recommend you consult with a lawyer. Here are some free resources that may be helpful too: Renown Health Foundation is proud to sponsor the Family Estate Planning Series put on by PBS Reno and the Community Foundation of Northern Nevada. The free, 8-week course of 90-minute, in-depth workshops is a great place to learn much more and to help you get started in the planning process. The next course begins on September 7, 2022. More information can be found here. Renown Health offers periodic advance health care directive workshops where attendees can learn about, complete, and sign their directive. The next workshop is scheduled for September 14th. More information can be found here. The American College of Trust and Estate Counsel provides information on a number of commonly asked estate planning questions here. If you are interested in including a charitable gift to Renown in your estate plan, we would be happy to talk to you about how your gift will make a difference for our mission. Please contact Abbey Stephenson at abbey.stephenson@renown.org or visit renown.org/LegacyGiving to learn about Renown Health Foundation’s Legacy Giving Society and ways to give.

-

Obras maestras para miembros de Sterling Silver Club

A Gallery-Worthy Member Artistry usually refers to a person’s ability to express their unique creativity in powerful and surprising ways. But there is also an art to living your life in ways that celebrate who you are, your limitless potential, the people you love and the community you care about. So imagine our delight to discover a Sterling Silver Club member and artist whose artistry of life reaches far beyond gallery walls. An Early Love of Art Born in Chicago, Illinois, Debbie arrived as the last of her parents’ three children and has two older siblings, Cynthia and Henry (a.k.a. Skip). As is usually the case, school played an important role in their shared childhood and Debbie remembers being drawn to art assignments in class from an early age. “When I was a young girl, I loved working on various art projects at school,” she recalls. “I always found myself learning something new and then teaching it to everyone I knew.” Later, Debbie would play violin in the school orchestra, join the swim team, and to continue to learn about art and its broader influence. “I remember taking a class and learning about color theory,” recounts Debbie. “I was so impressed with how colors relate to one another and also discovered how primary and secondary colors can be used together to make everything from products and advertising to what we wear more pleasing to the eye.” Expression-ism. “Art allows you to express yourself,” says Debbie. “And I’ve always been quite happy being expressive.” Though Debbie’s affinity for art was obvious, it wasn’t destined to be her career… at least initially. After earning degrees in marketing and public relations at North Central College in Naperville, Illinois and George Williams College of Aurora University in Williams Bay, Wisconsin, respectively, Debbie began what turned out to be a career in technology. In the Chicago area, she held positions as a systems analyst and computer programmer and a role in marketing and public relations for a computer software company. Then it was off to Los Angeles, California with her new husband, David, where she worked in sales and education for another software company. The couple returned to Elmhurst, Illinois to start their family but eventually moved to and settled in Minden, Nevada where David had an insurance business for 23 years and their children grew to become the adults their grandparents dreamed of. “My mom and dad would be most proud of our children,” beams Debbie. “They (her parents) always hoped for the best for them and would be over the moon that they are doing what they want to do, two of them in the field of medicine.” Debbie and David now live in Carson City, Nevada and their three children have established lives of their own. Jeffrey, the oldest, is a pastor and holds two master’s degrees. Rachael is an OB/GYN provider in Southern California and a graduate of University of Nevada, Reno School of Medicine (UNR Med). And their youngest, John-Henry, is finishing up his medical training and will soon be a trauma surgeon. Furry Family Members Debbie’s other “kids” are of the four-legged variety. “Mercedes and Bentley are really our luxury pugs,” she admits. “But are named after famous characters from books, not luxury cars.” She also says they are goofy, much-loved and simply melt the hearts of everyone they meet – “always!”